4xCube Review 2025

|

|

4xCube is #50 in our rankings of CFD brokers. |

| Top 3 alternatives to 4xCube |

| 4xCube Facts & Figures |

|---|

4xCube is an online forex and CFD broker registered and licensed in the Cook Islands. Clients can trade on popular financial markets and choose between three accounts based on their capital and trading strategy. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, metals, indices, cryptocurrencies |

| Bonus | 50% first deposit bonus |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | Yes |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSC Cook Islands |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs on forex, indices, metals, oil and cryptocurrencies with high leverage up to 1:500 and competitive spreads, with the choice between zero commission or raw spreads. |

| Leverage | 1:400 |

| FTSE Spread | 1.3 |

| GBPUSD Spread | 1.1 |

| Oil Spread | 0.08 |

| Stocks Spread | Variable |

| Forex | 4xCube offers 60+ currency pairs with competitive trading conditions. We like that all trading strategies are permitted including scalping and hedging. |

| GBPUSD Spread | 1.1 |

| EURUSD Spread | 0.7 |

| GBPEUR Spread | 0.9 |

| Assets | 50+ |

| Stocks | Direct stock trading isn't available, but traders can access 11 index CFDs, including the top US, British, European, Australian, and Japanese indices, with leverage up to 1:200. |

| Cryptocurrency | Trade five crypto CFDs with BTC, BCH, ETH, LTC and XRP paired with USD and leverage available up to 1:20. Digital currencies can be traded around the clock, including on weekends. |

| Coins |

|

| Spreads | From 4 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

4xCube, also known as 4XC, is an offshore broker registered in the Cook Islands. UK investors can access high leverage and trade forex, indices, commodities, cryptos, and forwards on the MT4 and MT5 platforms. This 4XC review will investigate the broker’s spreads, minimum deposit, demo account, withdrawals, welcome bonus, and safety track record.

4XC is a no-dealing-desk broker with fast execution speeds, spreads from 0.0 pips, and a choice of account types to suit different traders. New users can also get started in three straightforward steps and claim a welcome bonus. On the downside, 4xCube is not regulated by the Financial Conduct Authority in the UK.

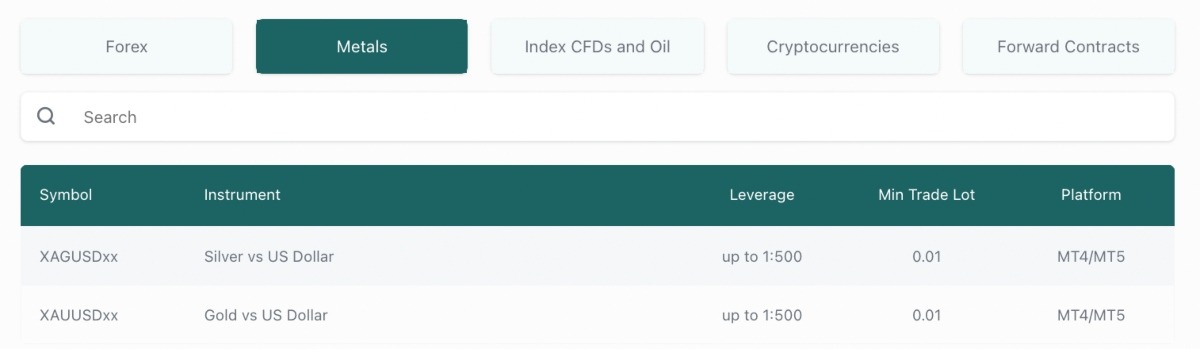

Market Access

4xCube offers a decent list of instruments, although it is limited vs some alternatives.

- Indices – Speculate on 11 major stock indices including the FTSE 100, S&P 500, and DE 40

- Commodities – Invest in popular commodities including Silver, Gold, Brent Oil, and Crude Oil

- Cryptocurrency – Trade 5 popular digital currencies; Bitcoin, Ethereum, Litecoin, Bitcoin Cash and Ripple

- Forex – Trade 60+ major, minor and exotic forex pairs. Available instruments include GBP/USD, EUR/GBP, and USD/JPY

- Forward Contracts – Invest in the Dollar Mini or Ibovespa Mini with contracts that will expire at a future date and time

The only major disadvantage is that there is no trading in individual stocks.

4XC Accounts

Investors can choose from three live accounts: Standard, Pro, or VIP.

Each profile provides different pricing conditions though most other features are similar. This includes a minimum trade size of 0.01 lots, access to 1:500 leverage, and four base currencies including GBP.

A swap-free solution is provided for the Standard profile only, though it was disappointing to see that these conditions are only available for 30 days after account opening.

Standard

- Commission-free

- Spreads from 1 pip

- £50 minimum deposit

- Forward contracts trading allowed

Pro

- Spreads from 0 pips

- £100 minimum deposit

- $5 commission per lot

VIP

- Spreads from 0 pips

- $4 commission per lot

- £10,000 minimum deposit

How To Open A 4XC Account

It is quick and easy to register for a live account:

- Complete the online application and select ‘Sign Up’

- Automatic redirection to the client portal will happen

- Upload your identity verification and proof of residency documents

- Make a deposit

- Start trading

Note, the broker aims to review verification documents immediately.

Trading Fees

4XC doesn’t offer the lowest trading fees around.

The Standard profile offers commission-free trading, with floating spreads from 1 pip. When we used 4XC, we were offered a spread of 1 pip on the GBP/USD currency pair, which is not as competitive as IC Markets, for example, offering a spread of 0.83 pips.

Pro and VIP account holders benefit from the tightest spreads as low as 0 pips, though commissions apply ($5/lot on Pro and $4/lot on VIP).

Unfortunately, with a £10,000 minimum deposit for the VIP solution, the best trading conditions will be out of reach for most beginners.

Overnight swap fees apply for positions held overnight.

Additional Charges

The broker also charges an inactivity fee after just one month. This is fairly expensive at $30 per account per month vs $0 at Pepperstone and $5 at XM after 90 days of no activity.

The HokoCloud VPS is free so long as a minimum balance of £5,000 is maintained and a trading volume of 4 round lot turns is completed per month. Failure to meet these requirements will result in a £20 fee per month.

Deposits

The lowest minimum deposit is £50 for the Standard profile which is competitive, and suitable for beginners. It was also good to see that payments are accepted 24/7.

GBP accepted deposit methods:

- AdvCash – Instant processing, no fees

- Globepay – Instant processing, no fees

- Visa and Mastercard – Instant processing, no fees

- Bank Wire Transfer – Processed in 2 to 3 days, no fees

- Cryptocurrency (Bitcoin, Bitcoin Cash, Dash, Tether, and Ethereum) – Processed within 24 hours, fees dependent on the network

How To Make A Payment To 4xCube

- Log in to the 4XC client portal with your registered credentials

- Select the ‘Funding’ page from the side menu and choose ‘Deposit’

- Select a payment method

- Enter the deposit details

- Review the payment and select ‘Confirm’

Withdrawals

4xCube withdrawals must be made back to the original payment method, which is fairly typical at reputable brokers. Withdrawals are also limited to one daily request, though the broker processes payments 24/7.

- AdvCash – Instant processing, no fees

- Globepay – Instant processing, 2% fee

- Cryptocurrency – Processing time dependent on blockchain, $10 fee

- Bank Wire Transfer – Processed in 2 to 3 days, €10 fee for SEPA or $49 for SWIFT

- Visa and Mastercard – Processed in 7 to 10 working days, 3% fee

Note, when we reviewed the terms and conditions, our experts found that 4XC charges for withdrawals within 48 hours of the original deposit, or if you don’t make a trade after funding a live account.

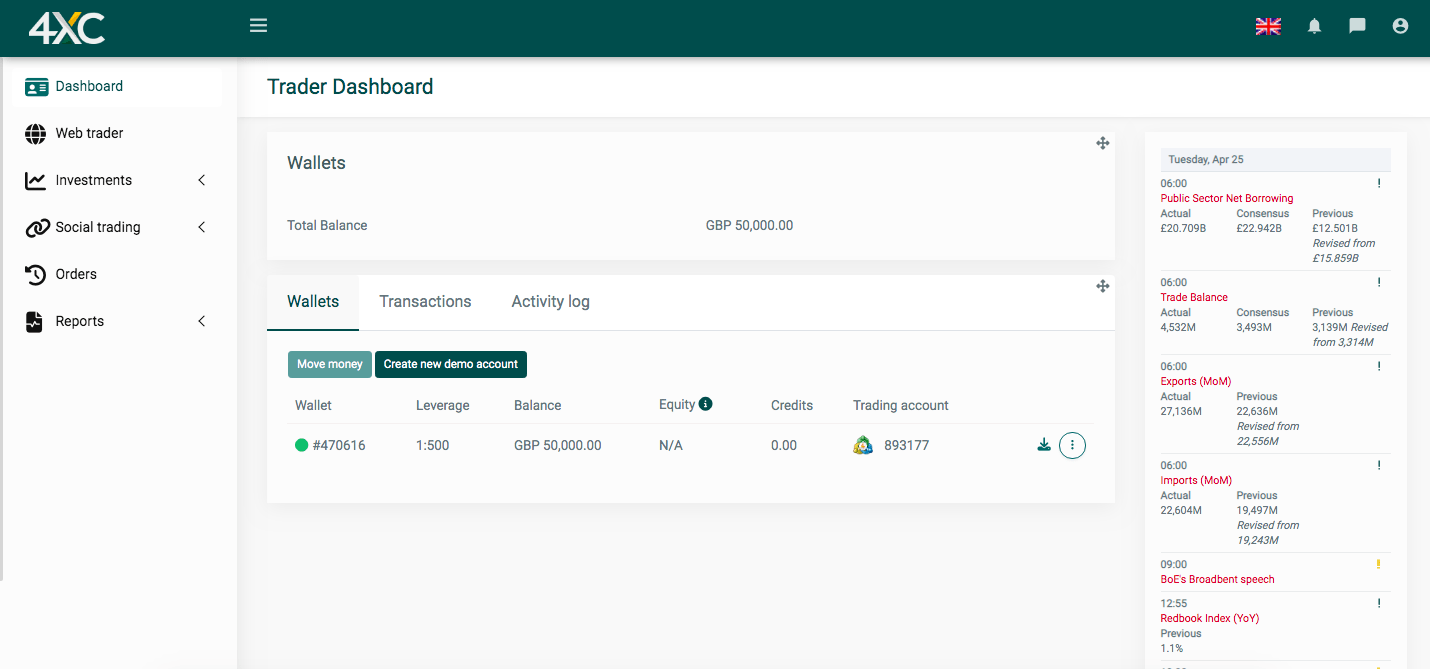

Demo Account

4xCube offers a free demo account for prospective clients. Paper trading profiles are loaded with £50,000 of virtual funds and offer 1:500 leverage.

You can choose to trade on MT4 or MT5 and select an account type (Standard, Pro, or VIP). A GBP base currency is also available. On the downside, the simulator has a 30-day limit.

To get started:

- From the 4XC.com website, select the ‘Demo Account’ icon from the top right of the homepage

- Complete the online application form

- Agree to the terms and conditions and the captcha

- You will be redirected to the client terminal

- Launch the trading platform

- Login with your registered credentials (sent to your email address)

Leverage

4xCube offers leverage up to 1:500. This is significantly higher than the 1:30 rates offered by FCA-regulated brokers.

Although increased purchasing power can lead to larger profits, losses can also be magnified.

The stop-out level is 50% and the margin call is 100%.

Trading Platforms

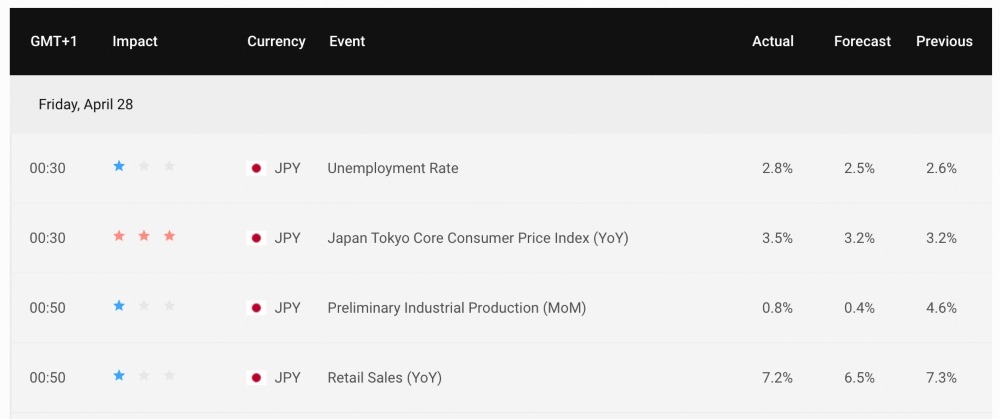

4xCube offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Both offer desktop downloads, as well as trading directly through major web browsers.

These terminals are ideal for forex and multi-asset trading, though MT5 provides more features including extra technical indicators and faster processing speeds. Key differences include:

- 9 timeframe views on MT4 vs 21 on MT5

- 31 graphical objects available on MT4 vs 44 on MT5

- 30 in-built technical indicators for MT4 vs 38 for MT5

- Depth of Market data (DOM) available in MT5 but not in MT4

- 4 pending order types for MT4 vs 6 pending order types for MT4

- Single-thread strategy tester on MT4 vs multi-thread testing on MT5

- No integrated economic calendar on the MT4 terminal but available on MT5

How To Trade

It is a similar process to open and close positions on MT4 and MT5. The easiest way:

- Select the ‘New Order’ icon from the top menu

- Choose the financial instrument to trade from the dropdown section in the pop-out

- Enter the trade details such as trading volume and stop loss or take profit parameters

- Choose the order type

- Press ‘Buy’ or ‘Sell’

All open positions can be found at the bottom of the MetaTrader interface. Double-click on the order you want to close and select ‘Close’ from the window pop-out.

Is 4XC Regulated In The UK?

4xCube Ltd is a registered broker in the Cook Islands. The company is regulated by the Cook Islands Financial Supervisory Commission (FSC).

Importantly, the regulatory authority is not as well respected as the Financial Conduct Authority (FCA). UK traders are not covered by the Financial Services Compensation Scheme in the case of business failure, for example.

However, the brand does have an active Professional Indemnity insurance policy of £1 million with Simply Business (SB). 4xCube also segregates client money from business funds, meaning it cannot be used to settle company liabilities.

All retail investors benefit from negative balance protection so you cannot lose more than your original investment.

4xCube is routinely audited by McMillan Woods.

Bonus Deals

As 4xCube is registered outside of the UK, it may offer welcome bonuses.

When we opened a 4XC account, we were offered a 50% welcome bonus. You must deposit at least £100 to be eligible, with a maximum bonus amount of £1,000.

Make sure you review bonus terms and conditions before signing up. Often there are restrictions on withdrawals.

Education & Resources

While using 4xCube, we were impressed with the education resources available, split by skill level; beginner, advanced, and expert. There are useful trading guides and online courses with topics relevant to experience.

We also liked the integrated platform videos demonstrating the fundamentals of opening orders, setting risk parameters, and using one-click trading.

Other resources available include an economic calendar, market trend data, and financial analysis, which is updated daily.

PAMM

The broker also offers a Percentage Allocation Management Module (PAMM). You can allocate funds to an experienced wealth manager and allow them to trade on your behalf.

Commissions vary between money managers, though they will only be paid if a minimum profit threshold is met. You can view strategy details and previous performance insights to help you decide where to invest your money.

To get started:

- Open a 4xCube live account

- Review money manager performance metrics and strategy ideas

- Invest funds in the chosen PAMM account and set risk management parameters (optional)

- Monitor performance in real-time and view realised P&L daily

HokoCloud

4XC traders can access the HokoCloud social investment solution. The tool offers copy trading where you can replicate positions in real-time, directly into the MetaTrader platforms.

Ideal for beginners, you can follow and copy trades of experienced investors. It is free to replicate positions of registered 4XC traders, while discounts are provided to review and follow strategy providers listed in the public domain.

Customer Service

4xCube customer service is available 24/5, which is fairly standard. There is also some support available on Saturday morning, though for UK investors this is during unsociable hours (12:00 am to 7:00 am GMT +2).

Contact methods include live chat, email, and telephone. When we tested the live chat service, we received a response in less than one minute. Our experts were also pleased to see a UK phone number.

- Email – support@4xc.com or info@4xc.com

- UK Telephone Number – +44 203 514 9306

- Live Chat – Access via the icon in the bottom left of each webpage

- Postal Address – 1st Floor, BCI House, Avarua, Rarotonga, Cook Islands

- Discord Channel – Download and join for updates and market insights

An FAQ section is also published on the broker’s website with articles and self-help guidance including how to get started with a 4xCube account and how to fund a live profile.

Company Details

4xCube Ltd was established in 2009 and registered in the Cook Islands. The brand previously traded under the name Geomatrix Ltd.

The mission of the company is to provide retail investors with access to the tools and guidance needed to succeed in the global financial markets.

The broker has been recognised with several awards, including praise for its customer service. Accolades include the Best Customer Support Broker 2022 and the Best Customer Service 2022.

Opening Hours

4XC follows standard market opening hours.

Forex can be traded 24/5 while digital assets are available 24/7. Forward contracts, on the other hand, can be placed for an expiry time in the future, though open positions are not rolled into the following months.

Holidays and market closures will be reflected in the trading platforms.

Should You Trade With 4xCube?

4xCube offers competitive trading conditions on the MT4 and MT5 platforms, alongside useful features like copy trading and a PAMM solution. Having said that, the list of tradable assets is small and regulatory oversight is lacking for UK traders.

Fortunately, the low deposit and demo account means 4XC could be worth a shot.

FAQs

Is 4xCube Legit?

4xCube is a legitimate broker regulated by the Cook Islands Financial Supervisory Commission (FSC). This offshore financial authority may not offer the same levels of customer safeguarding as brands overseen by the FCA. However, the broker does provide negative balance protection and segregated client funds.

Is 4XC A Good Broker?

Traders benefit from copy trading services, MT4/MT5 integration, a welcome bonus, responsive customer support, and high leverage up to 1:500. User reviews and ratings are also generally positive.

On the downside, the brokerage is not authorised by the FCA, reducing the trust score for British residents.

Does 4xCube Offer A Wide Range Of Instruments?

4xCube offers 100+ financial instruments. This includes forex, commodities, indices, cryptocurrency, and forward contracts. Although not the largest product line-up, there is a decent number of global assets. It is worth noting, however, that users cannot trade stocks.

Is 4XC Good For Beginners?

The minimum deposit requirement for the 4xCube Standard account is £50, making the brand accessible to new traders. A beginner-friendly copy trading tool, demo account, educational materials, and helpful customer support also make the broker a good option for novice investors.

Article Sources

Top 3 4xCube Alternatives

These brokers are the most similar to 4xCube:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Vantage FX - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

4xCube Feature Comparison

| 4xCube | IC Markets | FP Markets | Vantage FX | |

|---|---|---|---|---|

| Rating | 3.5 | 4.8 | 4 | 4.7 |

| Markets | Forex, CFDs, metals, indices, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting |

| Minimum Deposit | $10 | $200 | $40 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSC Cook Islands | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA | FCA, ASIC, FSCA, VFSC |

| Bonus | 50% first deposit bonus | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:400 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (UK), 1:500 (Global) | 1:500 |

| Visit | ||||

| Review | 4xCube Review |

IC Markets Review |

FP Markets Review |

Vantage FX Review |

Trading Instruments Comparison

| 4xCube | IC Markets | FP Markets | Vantage FX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | Yes | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

4xCube vs Other Brokers

Compare 4xCube with any other broker by selecting the other broker below.

Popular 4xCube comparisons: