1Market Review 2025

|

|

1Market is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to 1Market |

| 1Market Facts & Figures |

|---|

1Market offers 24/7 trading via leveraged CFDs. Trade popular financial markets with MT5 and the broker's own WebTrader. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities |

| Demo Account | Yes |

| Min. Deposit | $450 |

| Mobile Apps | Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT5 |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs on 600+ assets with leverage and low fees. |

| Leverage | 1:30 (EU), 1:500 (Global) |

| FTSE Spread | NA |

| GBPUSD Spread | 1.95 (Classic Account) |

| Oil Spread | 0.09 (Classic Account) |

| Stocks Spread | 0.02% Minimum |

| Forex | Trade 20+ currency pairs with raw spreads on leading platforms. |

| GBPUSD Spread | 1.95 (Classic Account) |

| EURUSD Spread | 1.8 (Classic Account) |

| GBPEUR Spread | 1.95 (Classic Account) |

| Assets | 21 |

| Stocks | Trade stocks and indices with competitive fees and high leverage. |

1Market is an offshore broker that offers CFDs on forex, stocks, indices, crypto, and more. This 2025 review will cover 1Market’s leverage, spreads, regulations, account types, and the registration process, giving retail traders everything they need to know before selecting this broker. Our UK team also share their opinion on 1Market.

1Market offers a decent range of products and reliable trading platforms in MT5 and a proprietary WebTrader. However, we are concerned about CySEC’s decision to suspend the broker’s licence. Our experts also found that 1Market is not regulated by the UK’s FCA.

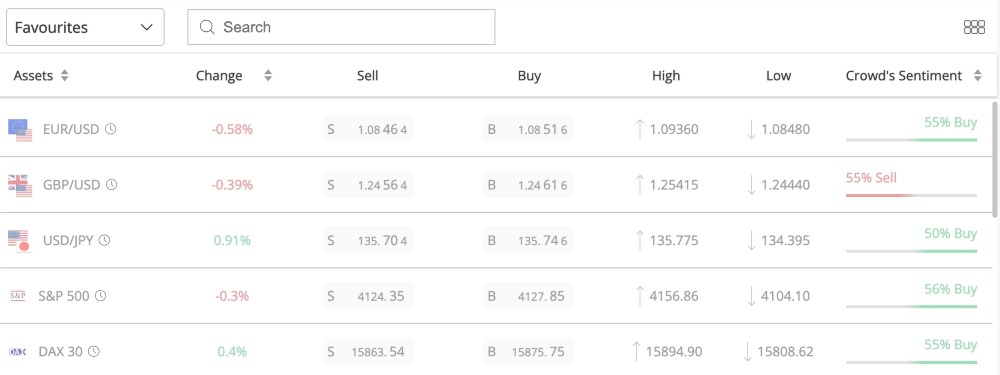

Market Access

We felt that 1Market offers a reasonably good selection of instruments and markets, but nothing exceptional. With just 350 stocks and fewer than 50 forex pairs, this is midrange for these asset classes, though we were pleased to see a good selection of cryptocurrencies.

Supported assets:

- 11 Indices: These include NASDAQ, S&P 500, and BIST 100

- 47 Forex: Major, minor, and exotic pairs such as GBP/USD, NZS/CHF, and EUR/AUD

- 6 Commodities: Silver, Platinum, UK Crude Oil, and Natural Gas to name a few

- 350+ Stocks: 1Market has access to hundreds of stocks, including Meta Inc, Direct Line, and Morgan Stanley

- 40 Cryptocurrencies: 1Market introduced crypto trading on its platform, providing users access to Dash, Bitcoin, Shiba Inu, LiteCoin and more

- 35 ETFs: These include DIA, VTI and USO

1Market Accounts

1Market offers clients three different account types – Classic, Premium, and Zero Spread accounts – but unfortunately, we did not find the options on offer very appealing. The main differences between the three are the minimum deposits, the minimum spreads, and the commissions, though all account types offer access to all available assets and allow micro lot trading.

We were disappointed to find a high minimum deposit of £10,000 to access the benefits of a Premium account, and some fairly high spreads on the Zero Spread account considering that a commission is also charged.

Classic

This account type has a minimum deposit of £450, which is quite high for the cheapest minimum deposit offered by an online broker. Spreads start from 1.8 pips and there are no commissions.

Premium

The Premium accounts have a minimum deposit of £10,000 and spreads start from 1 pip. Commission is not charged with Premium accounts.

Zero Spread

As the name suggests, this account type has a minimum spread of 0 pips. Commission is charged and is outlined under the ‘Fees’ section of this 1Market review.

The minimum deposit for Zero Spread accounts is £50,000, which is very expensive, considering that alternatives like XTB have no minimum deposit.

How To Register For An Account

We found it quick and straightforward to register an account with 1Market.

- Choose your desired account type by clicking ‘Go Classic/Premium/Zero Spread’

- Enter your basic contact details and set a password for your account

- For full access, click on ‘My Account’ on the 1Market dashboard and fill out the necessary details, including personal details, income, net worth, and trading experience

- Upload two pieces of ID such as a passport and driving license to complete full KYC verification

Funding Methods

Deposits

We were pleased to find no fees on 1Market deposits, which can be made via credit or debit card, bank transfer or e-wallets like Neteller and Skrill.

The deposit process is also straightforward; just click ‘deposit’ after you login to the portal page, input how much you would like to deposit, and select the payment method.

Withdrawals

We felt that 1Market’s withdrawals are somewhat unusual in the way they are linked to your deposit method. While it is standard for a company to process withdrawals to the same method as deposits, in 1Markets’ case the amount deposited is also taken into account.

If you made a deposit of $500 via Visa debit and you request a withdrawal of $700, you will be sent $500 to your Visa debit that you deposited with, and the additional $200 will be sent to your bank account via wire transfer.

There are no additional fees, but our experts found that withdrawals are slow as they can take anywhere between 3–14 working days to process.

Note that you will need to pass full KYC verification before you can request a withdrawal.

Fees

1Markets’ fees vary depending on the asset and which of the three account types is used, but we were generally not impressed by the rates charged. The bid-ask spread for forex on Classic and Premium accounts is quite wide, and ironically, the Zero Spread account charges both a commission and a bid-ask spread.

- Forex: Each forex pair has its own minimum and average spread. These differ for each account type. For example, EUR/GBP has an average spread of 1.95 pips with the Classic account, 1.3 pips with Premium, and 0.3 pips with the Zero Spread. These are reasonable but not the cheapest.

- Commodities: UK Brent Crude Oil has an average spread of 0.09 pips with Classic, 0.06 pips with Premium, and 0.01 pips with Zero Spread accounts.

- Indices: The minimum spread for index trading with a Classic account is 5 points, 3 points for Premium, and 0.2 points with Zero Spread accounts.

- Stocks: With all stocks, there is no difference in spreads between the three account types, the only differentiation is between the location of the company. The five locations are the UK (0.40%), the US (0.02%), the EU (0.02%), Poland (0.2%), and the Czech Republic (0.03%).

- ETFs: All ETFs have the same spread of 0.08% for all the account types.

- Cryptocurrencies: Ethereum has a commission rate of 0.5% for all account types. All other cryptos have a rate of 3%.

Note that the Zero Spread profile also charges commissions, with 50% of the total taken when you place the trade, and the other 50% taken when you close the position. The commission for forex and commodities is $7 per lot, $1 per lot for indices and 0.5% per volume of crypto trade. For stocks, there is a charge of $0.1 per stock and ETFs are $0.1 per ETF trade (both have a minimum commission of $0.05). Importantly, these commissions are in line with many alternatives.

Traders will also have to pay overnight fees (or receive them, depending on the direction of the trade). These differ between assets. 1Market traders should also note that while there are no roll-over fees on Friday or Saturday night, these will be added to the roll-over fees for Wednesday night.

1Market Regulation

We see 1Market’s regulatory status as a serious red flag, since the broker has been suspended by its previous regulator, CySEC, just one year after it was founded. The suspension was reportedly over issues related to the broker’s board of directors and regulatory compliance.

The 1Market website states that the brokerage follows standards for safe practice for financial and investment firms in the European Economic Area, called the MiFiD (Markets in Financial Instruments Directive) standards. However, it is not actually regulated by any EU or UK regulatory body.

Specifically, the Cyprus Securities and Exchange Commission (CySEC) suspended 1Market’s operator’s (Exelcius Prime) license after the company was under suspicion of violating section 22(1) of the 2017 Investment Services and Activities and Regulated Markets Law.

According to 1Market.com, the broker is owned by Podora Limited, which has headquarters in Majuro, Marshall Island. Podora Limited’s company number is 107838.

Exelcius Prime, 1Market’s parent firm in Cyprus, is still under examination. The company’s license number is 366/18.

Trading Platforms

We are glad to see 1Market offering traders a choice between two trading platforms: its own proprietary WebTrader and MetaTrader 5 (MT5).

It was disappointing to find no 1Market mobile app, but traders who need to access their terminal on the move can do so by downloading the MT5 mobile app for Android (APK) and iOS devices.

WebTrader

This platform has been created specifically for web use. When we used 1Markets, we found that the WebTrader is the best pick for newer traders, though the solution also offers a good selection of technical analysis tools.

It provides access to 10 timeframes, from 1 minute to 1 month. There are 19 different chart styles to choose from, such as Heiken-Ashi, Histograms, and Hollow Candle charts. Each one can also be edited to different time zones or can be made to a log-scale.

We were also pleased to see more than 120 different technical analysis tools that can be used to identify breaks and profit-making opportunities. These include a Volume Oscillator, Median Price line, Disparity Channels, and Correlation Coefficients.

Traders also get access to the Insight Live Feed, which provides live information on different assets. Some of the useful signals this tool presents traders include notifications about volume trade changes, increases in openings, or any trending trades.

MT5

MetaTrader 5 is the successor to MetaQuotes’ hugely popular MT4 platform, and it has proven to be almost as well-regarded among retail traders.

MT5 is the better pick for experienced traders with 21 timeframes, 38 technical indicators, and 44 analytical tools. It is also well-respected for its support of Expert Advisor trading robots, which can be created and customised using the programming language MQL5.

MT5 is a great option for those who wish to trade on the go as well as it is available to download on mobile devices.

Leverage

The leverage available at 1Market may appeal to traders with a large risk appetite, with high leverage of up to 1:500 available on the less volatile asset classes and 1:20 on offer for cryptocurrencies.

Traders should beware when margin trading, since losses can mount up quickly when high leverage is involved, though 1Market’s use of negative balance protection means they will be safe from becoming indebted to the broker.

- Forex: Leverage for major pairs is up to 1:500, minors are 1:200, exotics are 1:4

- Commodities: Natural Gas, Platinum, and Palladium all have a maximum leverage of 1:50. Metals and Crude Oil have a maximum leverage of 1:200

- Cryptocurrencies: The three fan tokens available on 1Market (Brazil, Portugal, Spain) all have a maximum leverage of 1:5. The others have a maximum of 1:20

- Indices: The BIST 100 has a leverage of 1:4. All other indices have a maximum leverage of up to 1:50

- Stocks: All stocks have a maximum leverage of 1:20

- ETFs: Like stocks, all ETFs have a maximum leverage of 1:20

Demo Account

Our experts are happy to report that 1Markets allows users to test out its two platforms via the use of a demo account. The simulator account has a balance of £10,000 in virtual cash, allowing traders to become accustomed to the trading platforms or test our strategies.

To open a demo account on the WebTrader, navigate to ‘Settings’ and toggle the ‘Demo Account’ option. This activates the demo account. You can always switch it off when you are ready to trade for real.

To open a demo account with 1Market’s MT5 platform, you will need to navigate to ‘My Account’ on the broker’s dashboard, then click ‘Start MetaTrader 5 Platform’. You will be taken to the MT5 platform (ensure it is already downloaded onto your device). On the pop-up window, press the option for ‘Demo’ and fill out the information required.

Bonuses

New traders may be disappointed to see a lack of welcome or deposit bonuses from 1Market, though the broker does offer a ‘refer a friend’ program which will earn referrers either 10% of the referred trader’s deposit each time they make one or 10% of the spread on each of their trades. To participate, you simply need to accept the terms and conditions and share the invitation link with your friend.

Once you enrol in the ‘refer a friend’ plan, it cannot be disabled or turned off.

Extra Tools

We felt that 1Market provides traders with a good range of additional tools and resources for education and support.

The account portal offers a comprehensive economic calendar, allowing users to browse and add important events to their personal calendars, enabling them to stay informed about potential impacts on their trading activities.

Additionally, a glossary of frequently used trading terminology is available, along with detailed explanations of each offered asset (such as forex, CFD trading, stocks, and indices).

In addition to the 1Market WebTrader, we were impressed by the firm’s 1nsight feature. This provides a live data feed, highlighting significant changes in volume, volatility, and potential emerging trends in asset prices. It also alerts users to any misleading breakout suggestions. The 1nsight Trading Gauge serves as a community platform where real traders using the platform can react to market movements.

1Market offers an educational service called 1Shield, designed to help traders learn secure trading practices, develop self-discipline, and effectively implement risk-management strategies. It covers essential information on regulation, margin, leverage, position orders, and provides some general trading tips. The tips may not be ground-breaking, but they do cover some important bases and provide a useful compilation for new traders.

Another tool that we like is Trading Central, which provides live trading signals. Accessible for free to 1Market traders who invest a minimum of $1,000, Trading Central is a third-party tool that assists in identifying profitable breakouts and making informed decisions on opening or closing positions.

The website also features a daily market report section, offering regular reviews of a selection of assets. However, it’s worth noting that the last report was published on September 12, 2022, coinciding with the date when CySEC suspended 1Market’s license indefinitely. Since then, the platform is again undergoing examination and there is a possibility of license reinstatement.

Customer Service

We felt let down by 1Market’s customer support, which should certainly be better manned given the company’s regulatory issues. The live chat function is listed on the website as ‘Chat with us now’ with the option to click on a link, however, the link does not take you anywhere.

Users can reach out to the support team through alternative channels, including email or phone:

- E-mail: support@1market.com

- Phone: +447723861200

However, the customer service team is not the most responsive, and the broker has received generally negative reviews online with other traders unhappy about the lack of customer support availability.

Company Background

1Market was founded in 2021 offering CFD, forex, stock, and index trading. With headquarters in the Marshall Islands, the broker offers a range of simple educational resources and uses the highly rated MT5 platform, being an attractive choice for many traders around the world, including the UK.

Originally licensed by CySEC, the broker landed itself in hot water after failing to comply with all necessary regulations, which resulted in a suspension of its regulatory license in September 2022. Since then, instead of being listed as ‘suspended’, the CySEC website states the broker is ‘under examination’.

The 1Market domain is also on the list of authorised domains.

Trading Hours

1Market is available to use 24/6, but the specific trading times vary between instruments. Forex is usually traded between Sunday–Friday or Monday–Friday. The specific hours are available on the website.

Commodities are available either Sunday 23:00–Friday 21:00 GMT or Sunday 22:01–Friday 21:00 GMT. Each commodity has a different time for ‘downtime’.

Indices, stocks, and ETFs all have different opening and closing hours depending on the exchange they are traded on. All cryptocurrencies trade Sunday from 00:00 to Saturday 23:59 GMT.

Should You Trade With 1Market?

1Market is an online broker that offers a good range of assets, and we were impressed to see the range of cryptocurrencies on offer. It also offers traders some reliable tools and resources and a good choice of trading platforms. The broker’s big problem is regulation, and it is difficult to recommend a broker that was suspended so soon after its launch, especially in such a dense market with many leading, FCA-regulated brokers

FAQ

Is 1Market Affordable?

The broker offers average spreads, although the spreads on the ‘Zero Spread’ account are much tighter. The Classic and Premium accounts have no commission for trading. However, the minimum deposits for each account are on the high side, and the jump from £450 for the classic account to £10,000 for a premium account is steep.

Is 1Market A Reliable Broker?

1Market does not have a long track record and has landed in regulatory trouble in the time since its launch in 2021. It may be better to trade with brokers with better reviews and a bigger presence on the trading map.

Is Trading With 1Market Halal?

1Market offers an Islamic, swap-free, trading account. This is only available for Classic and Premium profiles. To access an Islamic account (or to trade under any other type of account), you are guided to email the customer support team.

Does 1Market Offer Cryptocurrency Trading?

Yes, 1Market offers cryptocurrency trading. There are 40 available to trade, including big names like Bitcoin and three fan tokens in Spain, Portugal and Brazil.

How Do I Contact Customer Support At 1Market?

Customer support at 1Market is available to contact via phone and email. The UK phone number is +447723861200, and the email address is support@1market.com. On the downside, the live chat function does not work.

Article Sources

Top 3 1Market Alternatives

These brokers are the most similar to 1Market:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

1Market Feature Comparison

| 1Market | Swissquote | IG Index | FP Markets | |

|---|---|---|---|---|

| Rating | 1.5 | 4 | 4.7 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $450 | $1,000 | $0 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | 1Market Review |

Swissquote Review |

IG Index Review |

FP Markets Review |

Trading Instruments Comparison

| 1Market | Swissquote | IG Index | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

1Market vs Other Brokers

Compare 1Market with any other broker by selecting the other broker below.

Popular 1Market comparisons: