10TradeFX Review 2025

|

|

10TradeFX is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to 10TradeFX |

| 10TradeFX Facts & Figures |

|---|

10TradeFX is an offshore regulated forex and CFD broker. The brand offers MetaTrader platform integration with spreads as low as 0.1 pips. The broker offers true STP and ECN execution. The low minimum deposit, social trading and funded trader account programme makes 10TradeFX appealing to new traders. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Cryptos, Commodities |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | SFSA |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | 10TradeFX offers 200+ CFDs available to trade on the MT5 terminal. This is a relatively small range compared to most competitors I've reviewed. That said, the minimum deposit requirement to get started is only $50, which is great news for beginners. |

| Leverage | 1:600 |

| FTSE Spread | 200 |

| GBPUSD Spread | 1.5 |

| Oil Spread | 20 |

| Stocks Spread | 29 |

| Forex | My tests uncovered an average range of 40+ major, minor and exotic currency pairs with spreads as low as 0.1 pips and leverage up to 1:500. I like that the broker offers flexible contract sizes between 0.01 and 1 lot. |

| GBPUSD Spread | 1.5 |

| EURUSD Spread | 1.5 |

| GBPEUR Spread | 1.5 |

| Assets | 39 |

| Stocks | I was pleased to find some of the most liquid US and UK shares at 10TradeFX, though the range is fairly small compared to competitors. Commissions are reasonable at 0.10% and hedging is permitted. |

| Cryptocurrency | There are 10+ crypto instruments available, including Bitcoin, Ethereum and Litecoin. Again, this is pretty limited for active crypto traders but I am glad to see some popular altcoins available 24/7 including Polkadot and Chainlink. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

10TradeFX, also known as TenTrade, is a multi-asset CFD broker with a low initial deposit and a choice of account types and pricing structures. The demo account, copy trading tool, and comprehensive learning academy make 10TradeFX a good choice for beginner traders. Our review will evaluate the services offered by 10TradeFX including their fees, trading tools, instrument list, and more.

Our Take

- 10TradeFX is an offshore brokerage with high, flexible leverage up to 1:500 on a range of instruments

- The broker supports the MT5 trading platform only, with no other third-party or proprietary alternatives

- While the asset list is not the largest, it does include some nice additions including five NFT ranges

- The broker is not FCA-regulated which reduces its trust and safety score for UK traders

Market Access

10TradeFX offers a decent range of six asset classes, though we felt that, overall, the lineup lacked depth with only around 100 tradeable assets in total. Its selection of stocks, in particular, is below average. CMC Markets is a better option if you want to trade stocks with over 9000 global shares.

On a lighter note, the broker offers cryptos and NFTs which aren’t available at many UK-based alternatives. Another interesting product that is not commonly available is the IndexETF, which takes an average price of all global indices.

- Stocks – 50+ company shares including Amazon, Facebook, Tesla, and Shopify

- Cryptocurrency – Ten popular digital currencies such as Bitcoin, Ethereum, and Litecoin

- NFTs – Five non-fungible tokens including Sandbox NFTs, Gala Games NFTs, and Axie Infinity NFTs

- Forex – 40+ major, minor, and exotic currency pairs such as GBP/USD, EUR/GBP, GBP/JPY, and AUD/USD

- Commodities – Precious metals, soft commodities, and energies including UK oil, natural gas, gold, and wheat

- Indices – Nine index funds such as FTSE 100, AUS 200, ES 35, and CAC 40

Accounts & Fees

10TradeFX is not transparent when it comes to trading fees, which prevents traders from making accurate comparisons with competitors. 10TradeFX offers different prices for each account type, but a comprehensive list of fees by product is not available.

The pricing information that is immediately available is generally competitive, with the raw spread account matching the from-zero spreads and low commissions of top rivals. The spreads from the zero-commission Pro and Bonus accounts are okay, but still considerably wider than leading alternatives like CMC Markets, whose spreads start from 0.7.

TenTrade’s three live account types – Pro, ECN, and Bonus – all accept GBP as a base currency, plus EUR or USD. The Bonus profile has the lowest minimum deposit requirement at $50, with no commission and average spreads of 1.8 pips. We would recommend the Pro account, with a slightly higher initial deposit of $100, but guaranteeing tighter spreads from 1.2 pips and no commissions.

The ECN solution provides raw spreads from 0 pips and a commission fee of $3.50 per lot, per side. When we used the platform under Pro account conditions, we were offered a 1.3 spread to trade the FTSE 100 and 1.2 for the GBP/USD. Our experts found that trading shares will incur an additional 0.10% commission fee.

- Pro – Spreads from 1.2 pips, no commission

- Bonus – Spreads from 1.8 pips, no commission

- ECN – Raw spreads from 0 pips, commission of $3.50 per lot, per side

Swap fees will apply for positions held overnight, which is standard for all brokers. It was disappointing that there is no Islamic profile with swap-free trading opportunities.

How To Sign Up For A TenTrade Account

The registration process for a live 10TradeFX account is quick and simple to follow. We were able to get started in just a few minutes.

- Click ‘Register’ from the header of the broker’s website

- Select ‘Individual Client’ from the top dropdown menu of the application form

- Add your title, name, country of residence, date of birth, telephone number, and email address

- Agree to the T&Cs and select ‘Continue’

- From the dashboard interface, upload proof of identity and address to confirm your registration

Funding Methods

10TradeFX accepts several deposit types, and we were pleased to see GBP is accepted as an account funding currency. Payment methods include Skrill, bank wire transfers, cryptocurrency, and credit/debit cards. We were pleased to see the broker does not charge any deposit fees, however, third-party charges may apply.

Importantly, you must withdraw back to the original payment method.

How To Make A Payment

The cashier portal is easy to locate and navigate. To make a deposit:

- Log in to your 10TradeFX client terminal

- Select ‘Funds’ from the side menu and then click ‘Deposit Funds’

- Choose the account to add funds to from the dropdown and select a payment method from the ‘Deposit From’ menu

- Click ‘Continue’

- Input a deposit amount and review ‘Credited Amount’ – any fees will be automatically taken into account

- Confirm the transaction

Trading Platforms

TenTrade offers the MetaTrader 5 (MT5) platform only. While we are sorry to find no alternative third-party or proprietary trading platform, we are confident that MT5 is a great option with all the advanced functions and features needed to conduct price analysis.

This terminal is one of the leading tools in the industry, favoured by millions of retail investors worldwide. You can make use of the simple charting view, and integrate technical indicators, alerts and different timeframes as needed.

We have pulled out the most useful features based on our tests:

- Partial order filling supported

- Hedging and netting permitted

- Multi-thread strategy tester and simultaneous multi-currency backtesting

- 21 chart timeframe views, 38 technical indicators, and 44 analytical objects

- Depth of Market data displaying bids and offers of an underlying instrument

- Six pending order types including Buy Limit, Sell Limit, Sell Stop Limit, and Buy Stop Limit

- Integrated economic calendar with live news, company earnings release dates, and market consensus data

MT5 webtrader

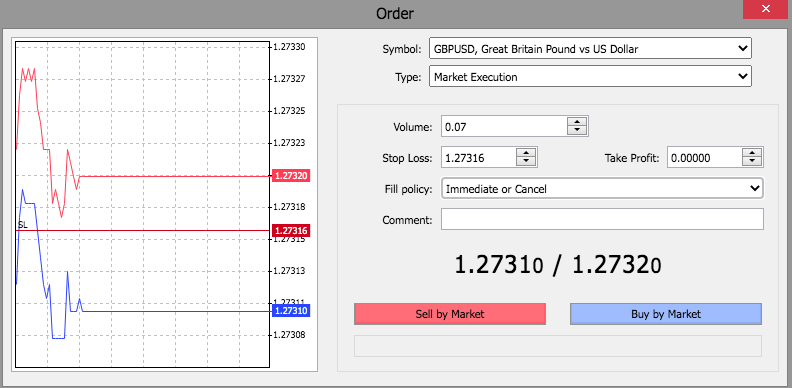

How To Make A Trade

I appreciate the clear order window at 10TradeFX. It means you can place a trade in a few straightforward steps:

- From the ‘Market Watch’ window, double-click on the instrument you want to open the ‘New Order’ screen

- Check the instrument is showing in the top dropdown menu

- Choose the order type (market execution or pending)

- Add the volume to trade (in lots)

- Choose a stop loss or take profit risk parameter (optional)

- Input a comment (optional)

- Choose ‘Buy’ or ‘Sell’ to confirm the transaction

Mobile App

The broker does not offer a proprietary mobile app, which is disappointing, as traders will need to log into 10TradeFX via their phone’s browser to manage their accounts.

However, MetaTrader 5 can be downloaded to iOS and Android devices as a mobile trading app, and we were pleased with the selection of powerful features available on the smaller screen version, including the full range of order types and account management tools. Charts and graphs have small device zoom and scroll functionality so you can review prices over a set period.

Leverage

10TradeFX offers high, flexible leverage, with levels between 1:1 and 1:500 available.

This is much more than could be achieved by investing with an FCA-regulated broker and can enhance profits as well as losses. We always recommend trading with risk parameters such as a stop loss to protect against amplified losses, and urge beginner traders to use modest amounts of leverage.

The broker has a 50% margin call and a 30% stop-out level on all account types.

Demo Account

Prospective 10ΤradeFX customers can trade on an MT5 demo profile, which is an excellent feature that we often recommend to new traders.

The paper trading profile provides access to all instruments, with flexible leverage of up to 1:500 and a virtual balance of up to $270,000. This is an excellent way to test out the broker’s services and learn all the popular functions offered on the MetaTrader platform. It can also be a useful and risk-free way to test out new trading strategies.

To open a demo profile:

- Sign up for a 10ΤradeFX account

- Click on ‘Accounts’ from the side menu and then choose ‘Open Demo Account’

- Select the ‘Leverage’ amount and ‘Initial Balance’ amount from the dropdown menus and select ‘Continue’

- Review demo trading conditions and select ‘Continue’

- Login credentials will be displayed on the following screen and emailed to your registered email address

Regulation

10ΤradeFX is licensed and regulated by the Seychelles Financial Services Authority, license number SD082. Although it is reassuring to have some regulatory oversight, this is not a top-tier organisation and we recommend that traders take into account the added risks of trading with an offshore broker.

Since the broker is not overseen by the Financial Conduct Authority (FCA), you will not have access to fund compensation schemes like the FSCS, or any of the other strict safeguarding measures offered by UK-registered firms.

On a more positive note, the broker does adhere to segregated client funds from business money and negative balance management systems.

We were also pleased to see the brokerage uses Secure Sockets Layer (SSL) encryption for all transmissions, which can help prevent fraudulent activities.

Bonus Deals

While using 10TradeFX, we were offered a $30 welcome bonus. This is not a very large incentive compared to the schemes offered by many competitors, but we were pleased to see the financial reward can be used to trade all instruments and that profits made using the bonus can be withdrawn.

Nonetheless, the availability of bonuses should never be the reason you open a trading account.

Extra Tools & Features

Funded Trader Programme

10TradeFX stands out for its prop trading, with a funded account size up to $500,000. This can be used alongside a traditional investment profile.

We liked the registration options, with either a flat fee of $100 for access to instant funding, or application through an evaluation challenge.

The profit split is decent at 70% for funded accounts, though this is not as competitive as some standalone prop trading firms such as Earn2Trade, which pays up to 80%.

Traders can access funded accounts with sign-up fees starting from $29 for $3000 in funding and can increase their funding amounts by achieving 10% profit targets within 60 days.

Instant Funding

- Mini – Balance size $3000. Minimum five trading days, 9% maximum drawdown, $100 registration fee, no profit scaling opportunity

- Bronze – Balance size $10,000. Minimum five trading days, 8% maximum drawdown, $300 registration fee, 10% profit target for scaling

- Silver – Balance size $30,000. Minimum five trading days, 7% maximum drawdown, $900 registration fee, 10% profit target for scaling

- Gold – Balance size $90,000. Minimum five trading days, 5% maximum drawdown, $2700 registration fee, 10% profit target for scaling

- Diamond – Balance size $270,000. Minimum 10 trading days, 5% maximum drawdown, $5000 registration fee, 10% profit target for scaling

- Master – Balance size $500,000. Minimum 10 trading days, 5% maximum drawdown, registration fee available on request, 10% profit target for scaling

Evaluation TenExpress Challenge

- Mini – Balance size $3000. $29 sign-up fee, 10% profit target, 9% overall drawdown, no minimum trading days, 60-day trading period to achieve the target

- Bronze – Balance size $10,000. $96 sign-up fee, 10% profit target, 8% overall drawdown, no minimum trading days, 60-day trading period to achieve the target

- Silver – Balance size $30,000. $255 sign-up fee, 10% profit target, 7% overall drawdown, no minimum trading days, 60-day trading period to achieve the target

- Gold – Balance size $90,000. $399 sign-up fee, 10% profit target, 5% overall drawdown, no minimum trading days, 60-day trading period to achieve the target

- Diamond – Balance size $270,000. $997 sign-up fee, 10% profit target, 5% overall drawdown, no minimum trading days, 60-day trading period to achieve the target

- Master – Balance size $500,000. $1497 sign-up fee, 10% profit target, 5% overall drawdown, no minimum trading days, 60-day trading period to achieve the target

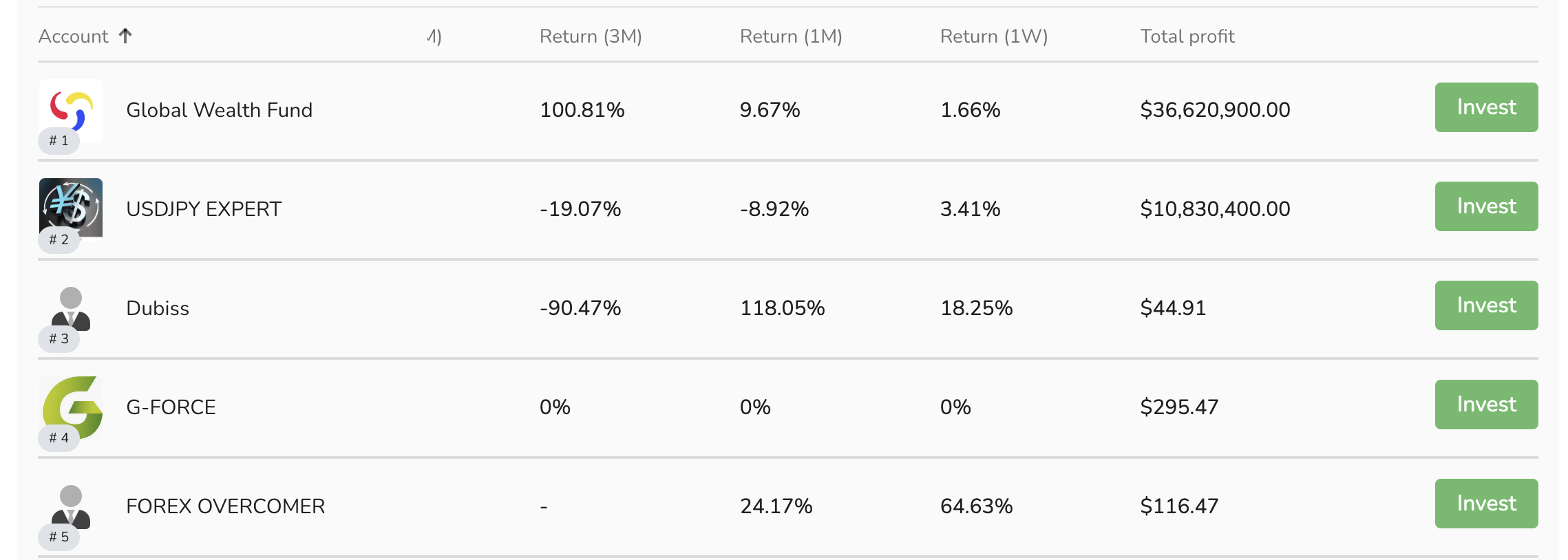

Social Trading

10ΤradeFX offers copy trading, which is a useful function for beginners or traders looking for a hands-off approach.

You can choose a subscriber to follow based on previous trading statistics and performance. Trades are then duplicated into your MetaTrader account.

We rated the transparent performance fees and minimum balance requirements published by the strategy providers. However, it is worth noting that these can vary significantly, with a typical minimum balance requirement of $100 and fees between 10% and 30% per trade.

Copy Trading Leaderboard

Education

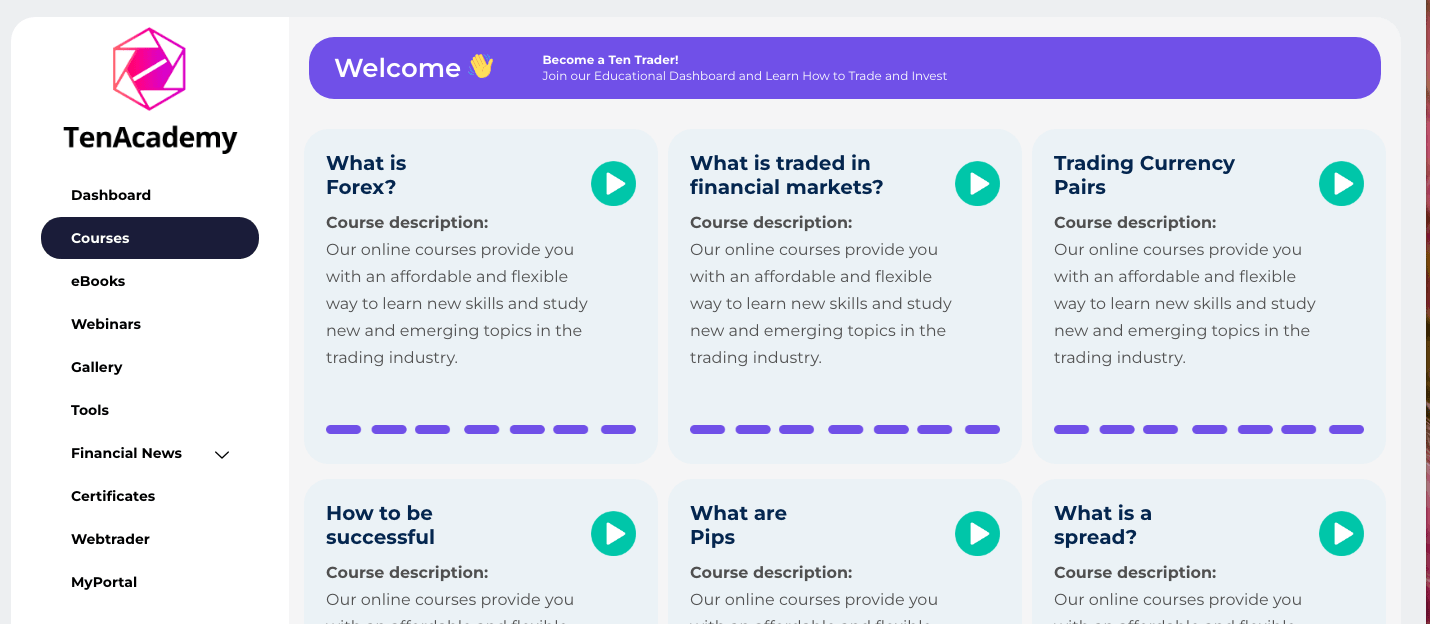

We think the TenAcademy educational platform is an impressive service that will suit newer traders. The dashboard hosts a catalogue of learning materials with topics ranging from basic to advanced presented via online webinars, courses, and e-books. With that said, seasoned traders can find better education and research from third-parties.

Other useful tools include a forex heat map, margin calculator, live market data, real-time charting, and fundamental analysis.

TenTrade Academy

Customer Service

TenTrade offers 24/5 customer support, though there are no UK localised contacts. You can speak to the broker’s team via live chat, email, telephone, and online enquiry form.

Our experts tested the live chat service and received a response in less than two minutes which is very reasonable, and we liked that there were no automated bot services to navigate initially.

- Telephone – 800.275.8777

- Email – support@10tradefx.com

- Online Enquiry Form – Via the ‘Contact Us’ webpage

We also found a basic FAQ section on the 10TradeFX website, though we thought the information was limited and were sorry to see no step-by-step user guides or detailed trading guidance.

Company Details & History

10ΤradeFX was established in 2020. The broker is the brand name of Evalanch Ltd and the company is registered as TenTrade Ltd. The broker is licensed and regulated by the Seychelles Financial Services Authority (SFSA).

10ΤradeFX is an ECN/STP broker, operating with no dealing desk intervention and low latency. Pricing is derived from top-tier interbank liquidity providers. The multi-asset brokerage operates with three main values: transparency, innovation, and community.

Trading Hours

Trading sessions vary by instrument. The broker’s platform follows a GMT+3 time zone, and we were pleased to see timings by instrument available on the ‘Contract Specification’ section of the website.

An economic calendar is also available with details of upcoming market closures and public holiday dates.

Cryptocurrencies and NFTs are not restricted by stock exchange opening times or the centralised forex market and therefore can be traded 24/7.

Should You Trade With TenTrade?

10TradeFX will appeal to a range of traders seeking high leverage with some nice added touches like NFT trading. The broker offers a good choice of trading tools including a funded trader programme, copy trading functionality, and an inclusive online learning academy. The MT5 terminal provides powerful features and rich technical analysis for more experienced traders.

Our only major concern is the lack of FCA oversight. This seriously reduces its safety score and British traders may prefer to open an account with a UK-regulated firm.

FAQ

Is It Easy To Register For A 10TradeFX Trading Account?

Yes, our experts were able to sign up for a 10TradeFX account in just a few minutes. The online registration form is basic, though stipulations must be adhered to and proof of identity and address must be uploaded via the client dashboard.

Does 10TradeFX Have Low Trading Fees?

10TradeFX trading fees vary by account type. The ECN account offers raw spreads from 0 pips and a commission fee of $3.50 per side which is in line with industry averages. The Basic and Pro profiles offer commission-free trading with spreads from 1.8 pips and 1.2 pips respectively. An additional 0.10% commission charge applies when trading stocks.

Is 10TradeFX Good For Beginners?

10TradeFX is suitable for beginners. Alongside a flexible demo account and $50 minimum deposit, novice investors can make use of the copy trading services and educational platform. With that said, UK traders can find beginner-friendly brokers that are also regulated by the FCA.

Does 10TradeFX Offer A Choice Of Trading Platforms?

We were a little disappointed to see that 10TradeFX customers can trade on the MetaTrader 5 platform only. There is no proprietary platform either, so traders do not have any choice of specialised or third-party software. With that said, we are confident that the world-leading MT5 platform will cater well to most traders.

Is 10TradeFX Safe?

10TradeFX is regulated offshore by the Seychelles Financial Services Authority (SFSA). Although this is not renowned globally as a trusted watchdog, we did find the broker offering some good safeguards such as negative balance protection and were pleased to find that it segregates client funds from business money. Still, we generally recommend FCA-authorised firms for UK traders.

Article Sources

Evalanch Ltd (10TradeFX) FSA Seychelles License

Top 3 10TradeFX Alternatives

These brokers are the most similar to 10TradeFX:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

10TradeFX Feature Comparison

| 10TradeFX | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 2.8 | 4 | 4 | 4.8 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $50 | $1,000 | $40 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:600 | 1:30 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | 10TradeFX Review |

Swissquote Review |

FP Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| 10TradeFX | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

10TradeFX vs Other Brokers

Compare 10TradeFX with any other broker by selecting the other broker below.

Popular 10TradeFX comparisons: