MetaTrader 4 Brokers

MetaTrader 4 (MT4) is the industry’s leading trading software, offered by most top brokers. In this user guide, you’ll find the basics of MetaTrader 4 explained as well as a tutorial on how to use the online platform. We also list the best MetaTrader 4 brokers in the UK 2025.

MetaTrader 4 Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 1989, CMC Markets is a reputable broker publicly listed on the London Stock Exchange. It holds authorisation from top-tier regulators such as the FCA, ASIC, and CIRO. The brokerage, which has received multiple awards, boasts a global membership exceeding one million traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

FXCC, a well-established brokerage since 2010, offers cost-effective online trading. Registered in Nevis and regulated by CySEC, it is distinguished by its ECN conditions and absence of a minimum deposit requirement. The account opening process is efficient, taking under five minutes.

Instruments Regulator Platforms CFDs, Forex, Indices, Commodities, Crypto CySEC MT4, MT5 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, FSA, CMA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

Founded in 2006, FxPro has built a reputation as a reliable non-dealing desk (NDD) broker, providing trading access across more than 2,100 markets to over 2 million clients globally. It has received over 100 industry awards, reflecting its favourable conditions for active traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

IC Trading belongs to the reputable IC Markets group. Designed for dedicated traders, it offers highly competitive spreads, dependable order execution, and sophisticated trading tools. However, it operates from Mauritius, an offshore financial centre, allowing high leverage but within a less regulated environment.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures FSC MT4, MT5, cTrader, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:500

Safety Comparison

Compare how safe the MetaTrader 4 Brokers are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| IG Index | ✔ | ✔ | ✔ | ✔ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the MetaTrader 4 Brokers support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| IG Index | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

Mobile Trading Comparison

How good are the MetaTrader 4 Brokers at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| CMC Markets | iOS & Android | ✘ | ||

| FXCC | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| FXPro | iOS & Android | ✘ | ||

| IG Index | iOS & Android | ✔ | ||

| IC Trading | iOS & Android | ✘ |

Beginners Comparison

Are the MetaTrader 4 Brokers good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| CMC Markets | ✔ | $0 | 0.01 Lots | ||

| FXCC | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| IG Index | ✔ | $0 | 0.01 Lots | ||

| IC Trading | ✔ | $200 | 0.01 Lots |

Advanced Trading Comparison

Do the MetaTrader 4 Brokers offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IG Index | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✘ | ✔ | ✔ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the MetaTrader 4 Brokers.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| CMC Markets | |||||||||

| FXCC | |||||||||

| IC Markets | |||||||||

| FXPro | |||||||||

| IG Index | |||||||||

| IC Trading |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Despite broadening its market range, the crypto options remain limited compared to brokers like eToro, and there is no facility for investing in actual coins.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- CMC Markets is well-regulated by respected financial authorities, ensuring a secure and reliable trading environment. It upholds a strong reputation, providing traders with confidence.

- The CMC web platform offers an exceptional user experience with sophisticated charting tools for trading and customisable options, suitable for both novice and seasoned traders. It supports MT4 but not MT5, and TradingView will be available from 2025.

- CMC provides competitive pricing with narrow spreads and low trading fees, except for stock CFDs. The Alpha and Price+ programmes offer additional benefits for active traders, including discounts on spreads of up to 40%.

Cons

- Although there have been improvements, the online platform still needs further refinement to match the user-friendly trading experience offered by competitors such as IG.

- A monthly inactivity charge of $10 is imposed after a year's inactivity, potentially discouraging occasional traders.

- Trading stock CFDs comes with a relatively high commission, particularly when compared to low-cost brokers such as IC Markets.

Our Take On FXCC

"FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account."

Pros

- FXCC has introduced MT5, which in our evaluations, mirrored the trading conditions of MT4 by offering swift execution, improved charting, and market depth tools.

- The complimentary education section, featuring the 'Traders Corner' blog, provides a wide array of resources suitable for traders of all experience levels.

- There are no limitations on short-term trading techniques such as trading and scalping.

Cons

- FXCC's exclusive MetaTrader platform is a limitation, especially when compared to more versatile options like AvaTrade, which offers five different platforms to cater to various trader needs.

- The variety of currency pairs surpasses most options, but the choice of other assets is limited. Notably, stocks are absent.

- While the MetaTrader suite excels in technical analysis, its outdated design detracts from the overall trading experience, particularly when contrasted with contemporary platforms such as TradingView.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- IC Markets provides some of the industry's narrowest spreads, offering 0.0-pip spreads on major currency pairs. This makes it an extremely cost-effective choice for traders.

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

Cons

- The tutorials, webinars, and educational resources require enhancement, lagging behind competitors such as CMC Markets, which diminishes their appeal to novice traders.

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

Cons

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

Our Take On IG Index

"IG offers a complete package with an intuitive online platform, top-tier beginner education, advanced charting tools through its TradingView integration, real-time data, and swift execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG stands out with its extensive range of instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it has recently introduced US-listed futures and options, along with an AI Index. These options enhance opportunities for diversification in trading.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- IC Trading offers top-tier spreads, with some major currency pairs like EUR/USD featuring spreads as low as 0.0 pips, making it an excellent choice for traders.

- IC Trading provides exceptional flexibility, allowing traders to open as many as 10 live accounts and 20 demo accounts. This enables the management of distinct profiles for various activities, including manual and algorithmic trading.

- Trading Central and Autochartist provide valuable technical analysis and actionable ideas. These tools are readily available within the account area or on the cTrader platform.

Cons

- Customer support was inadequate during testing, with multiple live chat attempts going unanswered and emails ignored. This raises significant concerns regarding their capacity to manage urgent trading issues.

- Although IC Trading operates under the reputable IC Markets group, it is licensed by the FSC in Mauritius, a regulator known for its limited financial transparency and lack of robust safeguards.

- Unlike IC Markets, IC Trading lacks support for social trading via the IC Social app or the ZuluTrade platform.

Due to its popularity, many of the best brokers offer MetaTrader 4, often alongside proprietary software.

Each broker will have their own spreads, fees and commission system. Regulated UK brokers offer free negative balance protection and limits on margin and leverage levels. MetaTrader 4 time zones are also set by the broker, meaning there are differences between the functionality of MT4 across brokers. But, with the MultiTerminal functionality, you can hold accounts with multiple firms.

As a guide, see a list of the best MT4 brokers. Most offer web and mobile downloads on Android and iOS.

What Is MetaTrader 4?

MT4 was developed in 2005 by MetaQuotes. The platform primarily facilitates forex trading, but investing is also available on a range of other markets, including Bitcoin (BTC), Ripple (XRP) and other cryptos. The software is licensed to brokers who typically offer it to clients at no cost.

How To Get Started With MetaTrader 4

Learning how to trade on MetaTrader 4 can seem daunting. Fortunately, we’ve compiled a few top tips for getting started.

Firstly, register for an account with an online broker who will provide you with MetaTrader 4 login credentials. A link to install the MT4.exe file is available directly from broker websites. You can also download the free zip from MetaQuotes. Alternatively, visit the MT4 web trader site.

Open the platform and login with the details provided by your broker. It’s recommended you start with a MetaTrader 4 demo account to practice how to trade before you make real investments on a live account.

System Requirements

MetaTrader 4 is suitable for download on Macbook, PC and Linux computers. However, some technical indicators are specifically designed for Windows, so the download of additional software such as Wine or Parallels is required to enable these functions.

MT4 is suitable for Windows 7 and 8 32-bit devices but the developers at MetaQuotes recommend a minimum of 64-bit processing speed and a Windows 10 software download where possible. Mac and Windows traders have been known to link their Raspberry Pi 3 to MT4. The platform is no longer available on Windows Vista or XP. MetaQuotes explained this move was to protect customers from vulnerabilities resulting from outdated software.

The MT4 4 app works for both Android APK (including Chromebook) and Apple devices such as iPhone and iPad. It is also compatible with Windows Phone 8.1, but reviews suggest functionality is limited and issues are frequent. App tutorials are available on many MT4 community forums.

How To Execute A Trade

The MT4 platform can seem intimidating at first, so we’d recommend you start on a demo account before trading with real money.

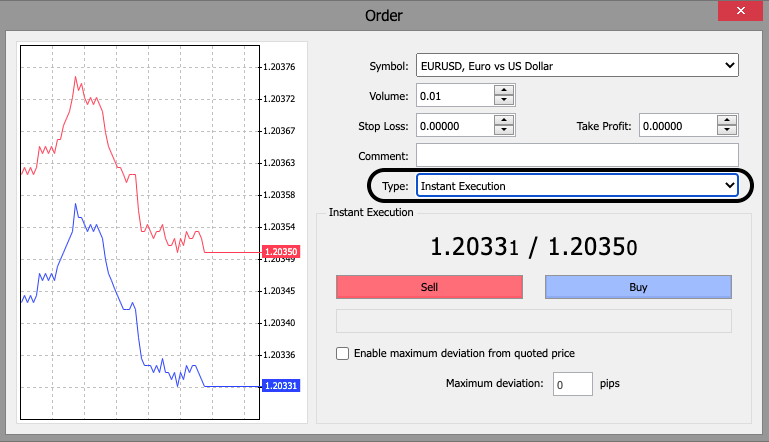

- From the MetaTrader 4 toolbar, click ‘New Order’ and then select your currency pair

- Select your order type: either ‘Market Execution’ or ‘Pending order’

- Input your position size in the volume field. In forex, 1 lot is equal to 100,000 units of the base currency, meaning 1000 GBP would be 0.01 lots

- Add any notes or comments. This functionality is great for those keeping a trading journal

- Click BUY or SELL

- You’ll then receive notification that your trade has been executed

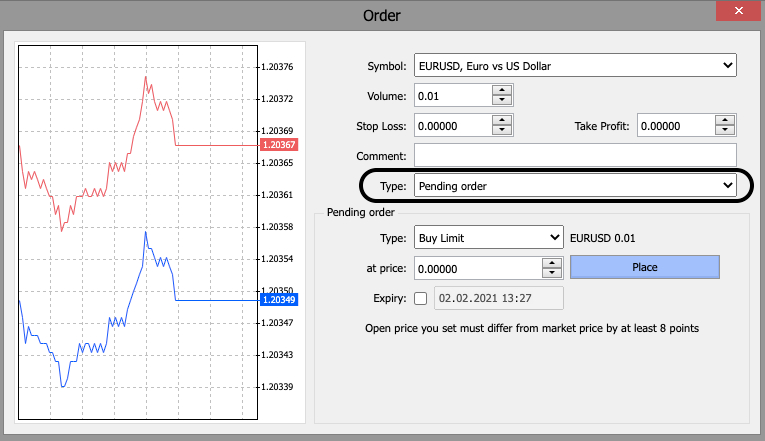

If you selected pending order as your order type, you’ll have the option to choose:

- Buy or Sell Limit – An order to buy or sell at a set price or lower

- Buy Stop or Sell Stop – An order that will not execute until it reaches a certain price

Then, enter your position size, stop loss and take profit levels. Set an expiry date on your pending order to help you manage your open positions. Click ‘Place Order’ to submit.

How To Edit A Position

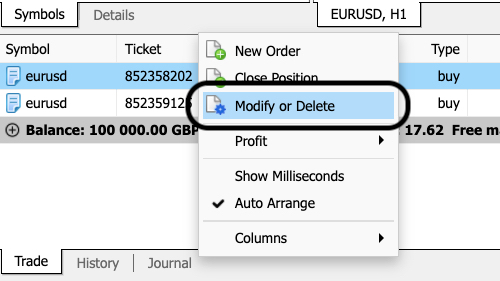

To edit a stop loss or take profit level, right-click on the position and select ‘Modify or Delete Order’. Edit as required and hit ‘Modify’.

To create a trailing stop, right-click on your position and select the number of points you would like to apply. To remove the trailing stop, right-click again and select ‘None’.

To close a position entirely, right-click and select ‘Close Order’, then click the yellow button.

Keyboard Shortcuts Explained

MT4 has a few keyboard shortcuts that make it easier to navigate, these include:

- New Order – F9

- MT4 User Guide – F1

- Launch MetaEditor for indicators and Expert Advisors – F4

- Full-Screen Mode – F11

- Activate/deactivate EA – Ctrl+E

- Enable Crosshair – Ctrl+F

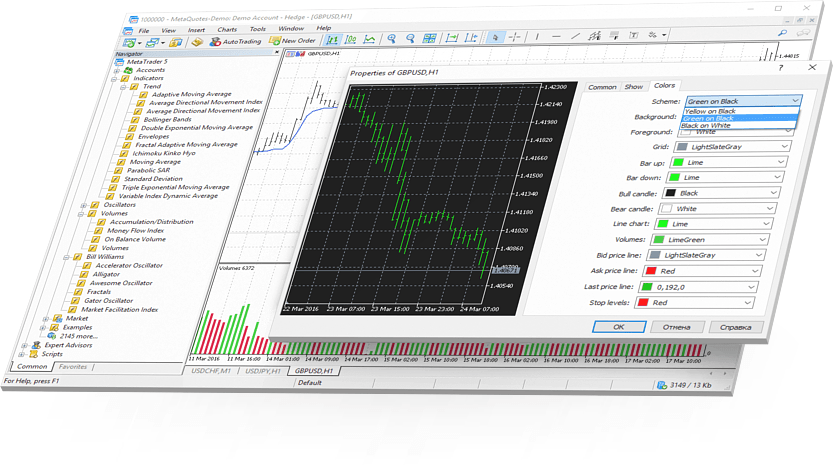

MT4 Trading Charts

Chart functionality is a highly praised feature on MetaTrader 4. All the charts are customisable. You can change the colours for entry-level and stop-loss lines and even select your own background colour.

You can easily change the timeframes of the charts by clicking through the default options.

- M = minute (i.e M5 means five minutes)

- H = hour (i.e H1 means one hour)

- D = day (i.e D1 means one day)

- MN = month (i.e MN2 means two months)

But, you don’t have to stick to those available. Timeframes are also customisable so you can create a 3 minute, 10 minute or 8 hour chart if required.

If there’s functionality you believe would improve usability, it’s likely someone has created a Java API add-on for this. Search the MetaTrader 4 community for pips calculators, candle time and spread indicators.

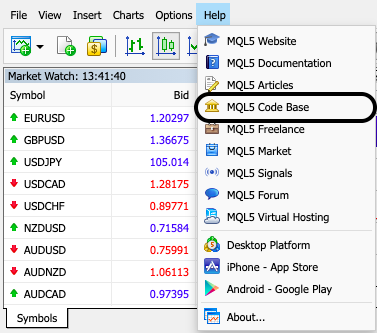

Expert Advisors

MT4 has an extensive Codebase where you can buy and sell Expert Advisors to help with your trading strategy. An Expert Advisor, or EA, is an automated trading robot. They use algorithms that look at signals in historical and real-time data that execute trades according to a pre-determined logic. You can create your own EA on MT4, but to do so, you’ll need to use a programming language such as Python. EAs are similar to copy trading where you mirror successful trader positions automatically.

It’s important you exercise caution if you want to buy an off-the-shelf EA. Since trades will execute automatically, it’s crucial you have evidence of thorough backtesting and historical profitability or you could see your account emptied in a flash.

For your EA to work, you’ll also need to download a Virtual Private Server (VPS) to MetaTrader 4. The platform restricts trading to when you’re using it. A VPS enables trades to be executed even while you’re away. They also speed up execution, preventing slippage.

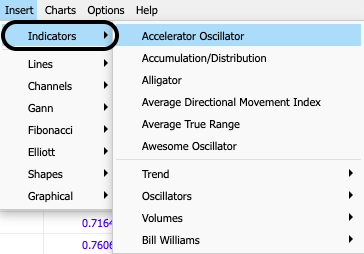

MT4 Indicators

Dozens of built-in indicators are offered. To add an indicator to your chart, go to ‘Insert’ and ‘Indicators’, you’ll then see a selection. But, being MetaTrader 4, these are highly customisable. You can even create your own from scratch if you need to. So, if you want a Zigzag, EMA, B-clock or Elliott Wave indicator, you’re not necessarily restricted by your broker’s default options.

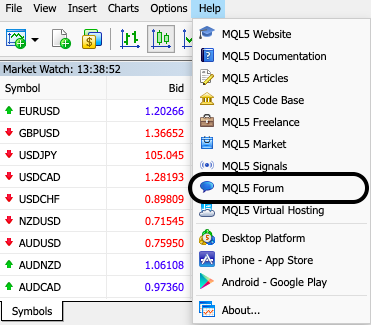

MT4 Customer Support

Contact the MT4 Technical Support Centre for help with troubleshooting. If the platform keeps crashing, is frozen or just not working, start by closing the application and restarting your computer. If you’re still seeing glitches or it’s not loading, your laptop software may need updating.

Common problems with MetaTrader 4 include the ‘off quotes’ error message. This can occur if there are connectivity issues or the best price is not within the ‘maximum deviation’ parameters set.

The ‘invalid account’ error is usually due to incorrect login credentials. Check these notifications with your broker. It will keep saying this if you’re trying to access your account during weekends and holidays outside of market trading hours.

If you’re still having problems, try the ‘Contact Us’ page where an MT4 Manager can help with most questions.

Since MetaTrader 4 is one of the most popular trading platforms, the online community is vast. If there are widespread issues e.g a server is down, not responding or keeps freezing, the community will be talking about what is wrong through online forums. Often they’re a great source of troubleshooting and will be able to tell you if you cannot place an order because there are new plugins you must have, or you’re waiting for an update. Plus, there are hundreds of user guides and tutorial PDFs to explain everything from swaps to signals.

Platform Comparison

MetaTrader 4 vs MetaTrader 5

Both platforms are hugely popular in the forex trading community. They offer extensive customisation and analysis. However, there are marginal differences when you compare the two. For example, MT5 has eight more indicators and there are six types of pending orders vs MT4, plus the slick option to view your screen in dark mode.

But, the primary difference is that MetaTrader 4 was designed for forex traders, whilst MT5 was built to include trading on CFDs on commodities such as gold, stocks and futures. Contrary to popular belief, one is not an upgrade of the other. They have different purposes. Those keen to trade on the S&P 500 or US 30 will prefer MT5.

MetaTrader 4 vs TradingView

TradingView now offers real-time trading, making it a strong competitor for MetaTrader 4. In fact, MT4 is increasingly difficult to run on macOS with the new Catalina update. Therefore, Mac users often find TradingView a good alternative. Proponents love the 100 indicators vs the measly 30 on MT4. It’s also generally a fresher interface – with MT4 looking reasonably outdated these days. Of course, there’ll always be MT4 loyalists due to the extensive list of broker partnerships.

Proprietary Software

Many of the best brokers offer their own proprietary software as an option. But, when you compare the functionality on MetaTrader 4 vs its competitors, there’s no contest. For example, XTB is great for those who trade stocks, but for the technical charting required for forex, MT4 takes the podium. XTB do not offer MT4 for traders.

Brokers such as IG, and eToro also have their own downloadable software but tend to offer the MT4 platform alongside it because of its popularity. Other leading brokers that offer MT4 include FXPro and Admiral Markets.

How To Withdraw Funds From MT4

To withdraw funds on MetaTrader 4, go to Money Operation within the Trader’s Room and click ‘Withdraw Funds’. Fill in the amount you’d like to request. Withdrawal times and fees vary between brokers. Note, you will get a ‘not enough money’ error if you do not have the account balance requested.

Final Word On MetaTrader 4

MetaTrader 4 can seen intimidating for new traders. But, with just a little training, you’ll be on course to start a career in forex. Many of the most popular brokers use the platform, so you’ll have no trouble finding one you’d like to work with. Executing trades, withdrawing funds and adding customisable indicators is easy. But, as forex trading popularity explodes, competitor platforms are emerging with increased default functionality and fresher charts.

FAQ

Which Are the Best MetaTrader 4 Brokers?

We list the best UK MetaTrader 4 brokers with full reviews and feature comparison. No single MT4 broker is best for all traders, we recommend you use our top list to compare them on the features, fees and pros/cons that are important to you.

Is MetaTrader 4 Legit?

MetaTrader 4 is perhaps the most popular forex trading platform on the market. It is offered as an option for traders at over 750 brokers worldwide, even alongside proprietary software. However, traders should check that the broker they trade with is regulated. MetaQuotes, the developers behind MT4, do not necessarily endorse brokerages that own a licence to the software.

Can You Make Money On MetaTrader 4?

Yes, MetaTrader 4 is a platform that facilitates forex trading. Successful traders across the globe have learned how to utilise the software to make profitable trades. But upside is not guaranteed. Traders should be aware that extensive analysis and market knowledge is required. See our guide to forex trading on MetaTrader 4.

What Are The Computer System Requirements For MetaTrader 4?

MetaTrader 4 was created for Windows PCs. However, Mac and Linux users can trade on the platform by downloading additional software such as Wine or Parallel.

Is MetaTrader 5 Better Than MetaTrader 4?

MetaTrader 4 continues to be the most popular trading platform for forex traders. However, MetaTrader 5 does have additional functionality, including more indicators, pending orders and customisation. MT5 is better suited for trading stocks, options and CFDs. Which is better is primarily down to trader preference.

How Do You Download MetaTrader 4?

MetaTrader 4 can be downloaded directly from your broker. Sign up to an account with your chosen brokerage. You’ll then receive MT4 login credentials. Load your account with funds or for newbies, activate a demo account and get trading.