Best Demo Trading Accounts For 2026

Demo accounts act as virtual trading platforms, letting you practice buying and selling financial instruments without risking real money. They’re ideal for newcomers learning the ropes and also useful for seasoned traders experimenting with new techniques.

Browse our selection of the best demo trading accounts, reviewed by UK-based experts with hands-on experience executing countless paper trades on hundreds of demo platforms.

Top Demo Trading Accounts In The UK

-

In our assessments, XTB’s demo accurately replicated its live xStation 5 platform, featuring over 5,000 assets like forex, indices, commodities, stocks, and crypto. Execution was rapid through CEC liquidity, with EUR/USD spreads starting at approximately 0.6 pips and minimal slippage. Setup required only an email, provided a $100,000 virtual balance, and the demo had no expiration.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

In our tests, Vantage's demo provided real-market ECN conditions through MT4/MT5/cTrader. EUR/USD spreads were between 0.0 and 0.2 pips, with a $3 round-trip commission. Execution was fast with minimal slippage. Setup required just an email, offered up to $500K in virtual funds, and never expired—ideal for realistic strategy development.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

In our recent tests, Pepperstone’s demo reflected live spreads—EUR/USD averaged 0.1–0.3 pips with Razor accounts. Execution proved swift, with little slippage and over 1,000 assets available. The interface precisely mimicked the real trading environment. No personal information was needed, offering a 30-day trial with up to $50,000 virtual funds.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Using Interactive Brokers' demo mirrored the live TWS platform, featuring global market access and advanced order types. Execution speed felt genuine, although fast-moving assets experienced slight slippage. Basic details were needed for setup. With a virtual balance of $1M, paper trading started post-account approval.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

In our tests, Eightcap's demo account matched actual trading conditions with live pricing and execution. Accessible via MT4, MT5, and TradingView, it offers over 1,000 instruments like forex, indices, commodities, stocks, and crypto. Setup merely required an email, offering a $5,000,000 virtual balance for 30 days, extendable on request. Perfect for both novice and experienced traders seeking realistic practice.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

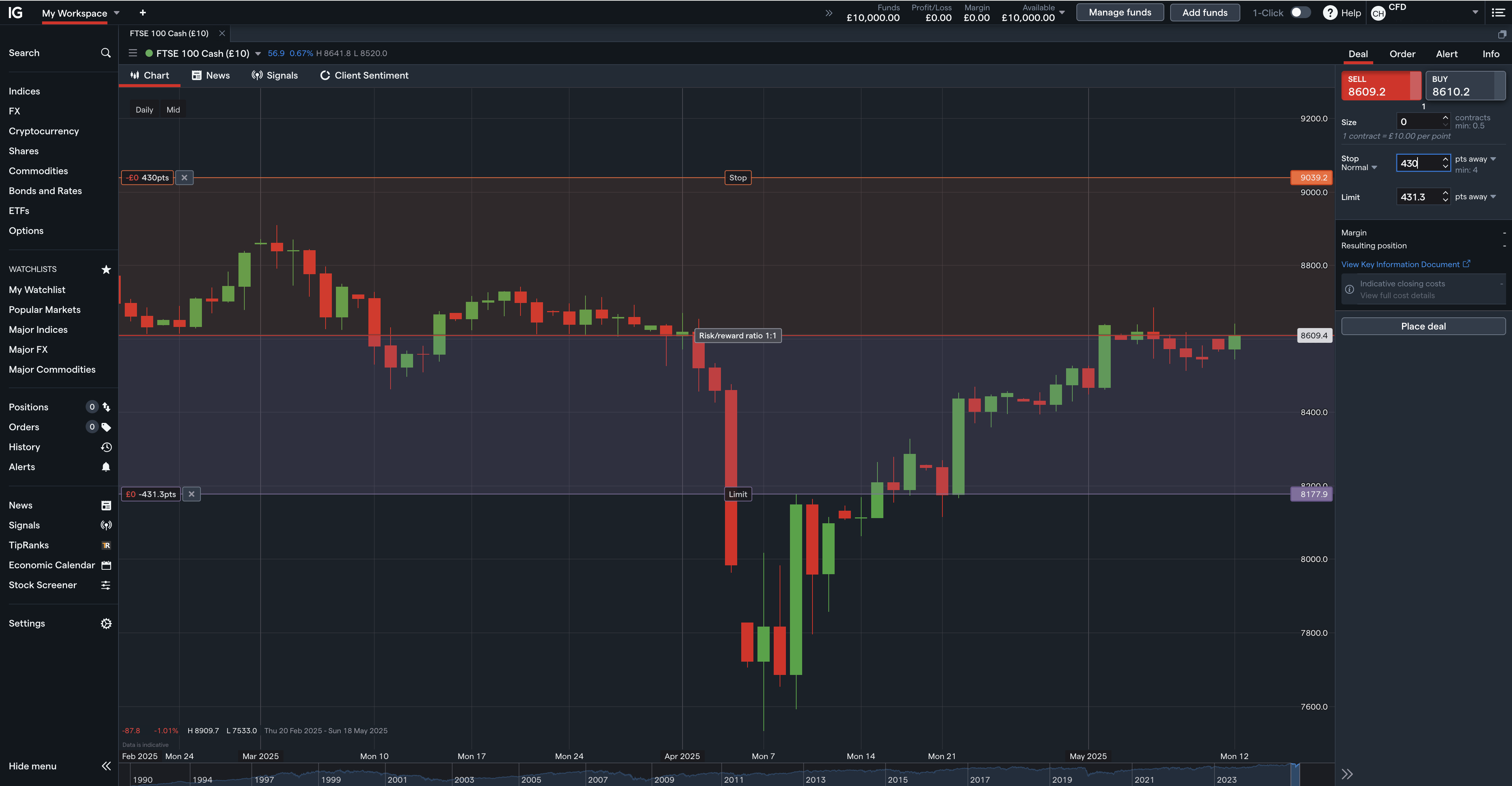

In our assessment, IG's demo account provided a $10,000 virtual fund. Execution was dependable with minimal slippage, and real-time market data was accessible. There is no time restriction. Setup required just an email, and users can replenish their virtual funds anytime. The platform is available via MT4, ProRealTime, L2 Dealer, and WebTrader. IG Academy also offered superb educational resources.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro)

Safety Comparison

Compare how safe the Best Demo Trading Accounts For 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Demo Trading Accounts For 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Demo Trading Accounts For 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| XTB | iOS & Android | ✔ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Pepperstone | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ |

Beginners Comparison

Are the Best Demo Trading Accounts For 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| XTB | ✔ | $0 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Demo Trading Accounts For 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Demo Trading Accounts For 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| XTB | |||||||||

| Vantage FX | |||||||||

| Pepperstone | |||||||||

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| IG |

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

Cons

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

- Opening a live account is both straightforward and swift, requiring under 5 minutes to complete.

Cons

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

- Global traders can use accounts in various currencies.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

How Did Investing.co.uk Choose The Best Demo Accounts?

To identify the top brokers offering demo trading accounts, we followed a comprehensive evaluation process.

This method ensures our recommendations reflect both quantitative data and real-world usability:

- Reviewed our evolving database comprising hundreds of online brokers, all welcoming UK-based investors.

- Identified brokers that offer free demo accounts, confirming availability through hands-on testing.

- Ranked each provider based on overall performance, using a combination of over 200 data metrics and our own in-depth experience using their demo trading platforms.

What Is A Demo Trading Account?

A demo account is a free, interactive trading mode that most online brokers offer to help prospective clients explore their platforms and understand market mechanics before committing real capital.

These simulated accounts mirror live market conditions, allowing you to practise investing in UK and global financial instruments—such as FTSE 100 stocks, GBP/USD currency pairs, or UK government bonds (gilts)—in a risk-free environment.

Demo accounts are funded with virtual money, which varies by provider but typically ranges between £10,000 and £100,000 from our investigations.

This allows you to experiment with strategies and become familiar with order types, platform tools, and market behaviour without financial consequences.

IG’s powerful demo account lets you trade real market prices with virtual funds

While some demo accounts offer unlimited access, many are time-limited, usually expiring within 30 to 90 days. Still, this is often enough time to evaluate the platform and test basic strategies.

These practice accounts can be invaluable for investors, especially if you’re considering leveraged products like CFDs or spread betting.

Leveraged trading amplifies profits and losses, so gaining experience with virtual funds can help mitigate early mistakes and build confidence before entering the fundamental markets.

When I started, using a broker’s demo account was a game-changer for me, not just because I could test strategies risk-free but also because it revealed how I actually react under pressure.Watching a simulated trade swing £1,000 in minutes showed me more about my emotions than any book ever could.

What To Look For In A Demo Trading Account

In recent years, we’ve watched online brokers in the UK significantly increase their spending on technology upgrades, educational content, and promotional deals to attract new traders.

Despite these advancements, demo trading accounts remain among the most effective and widely used methods for engaging potential clients.

However, after testing numerous demo platforms, it’s clear to use that not all trading simulators offer the same quality or user experience—some are far more realistic and functional than others.

To help you get started, here are the key factors to keep in mind when choosing a demo account for trading:

1. What To Trade

The first step is to decide which asset class—or combination of asset classes—you’re interested in trading. This matters because not all brokers we’ve evaluated support the same range of instruments, and some limit the assets available in their demo accounts compared to live trading.

For example, OKX is focused primarily on cryptocurrencies, which may suit those specifically interested in digital assets.

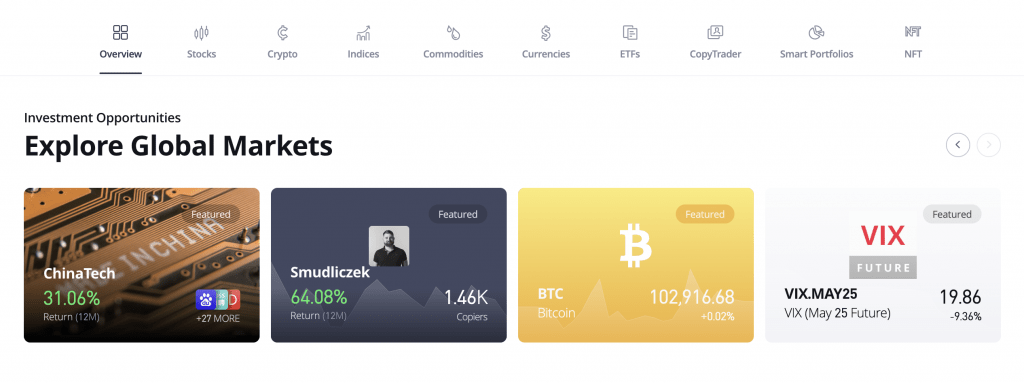

In contrast, multi-asset brokers like eToro give you access to a wide variety of markets, including UK and international stocks, commodities, indices, ETFs and even cryptocurrencies.

Choosing a broker that aligns with your trading interests will ensure your demo experience closely reflects the live trading environment you’re preparing for.

eToro offers an extensive range of assets that you can paper trade on one platform

2. Bankroll Size

Another key consideration is how much virtual capital the broker provides in the demo account. A larger simulated balance allows you to place bigger trades, test more complex strategies, and extend your practice period before exhausting the funds, helping to create a more realistic trading experience.

The amount of virtual money varies significantly between platforms from our tests. For instance, UK-regulated brokers like City Index and FOREX.com typically offer £10,000 to get started.

Plus500 provides a more generous £40,000, while XTB goes further with £100,000. IC Markets is one of the few that offer unlimited demo funds, which can be particularly useful for extended practice or high-volume strategies.

Some platforms also let you manually top up your demo account or through customer support. At eToro, for example, you can request to double your $100,000 demo balance by contacting the support team—ideal if you’re testing riskier or leveraged positions.

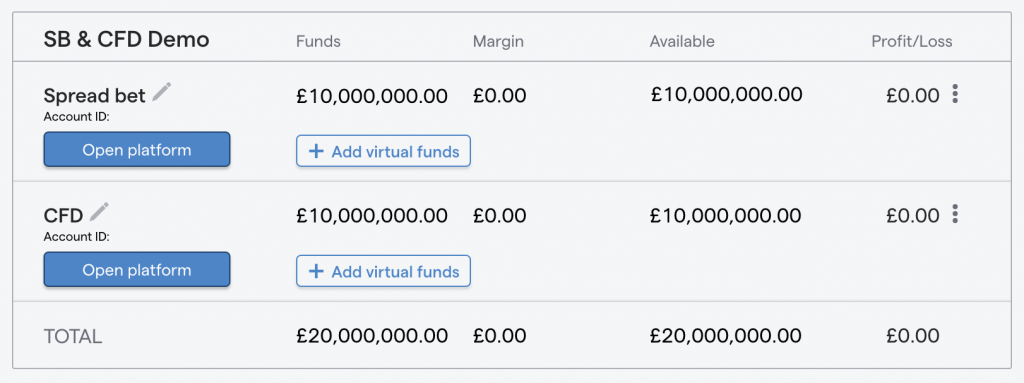

It’s also worth noting that demo funds can differ depending on the product type. IG provides a huge £20,000,000 in practice capital, split evenly between its spread betting and CFD demo accounts.

This reflects how real-money accounts are separated based on product type and regulation, which is especially important for UK investors navigating FCA rules.

IG’s £20m virtual funds is perfect for testing strategies across spread betting and CFDs

3. Trading Timeframe

Consider how long you’ll need access to a demo account, especially if you’re a beginner who may benefit from a more extended practice period.

An extended timeline allows you to explore different asset classes properly, learn to use trading tools, and test various strategies without pressure.

In our experience testing numerous demo platforms, we’ve found that many brokers impose time limits on their demo accounts. Once the trial period ends, you may lose access to the simulator unless you upgrade to a live account.

The duration of demo access varies widely. For example, XTB offers a 30-day trial, which may suit more experienced users. On the other hand, easyMarkets provides unlimited demo use, making it a more flexible choice for newer or more cautious traders.

You should also be aware of inactive policies. Some demo accounts are automatically closed if not used for a specific period. IC Markets, for instance, expires demo accounts after 30 days of inactivity.

Always check a broker’s terms before signing up, especially if you plan to take your time before transitioning to a live account.

Traders often underestimate how quickly a 30-day demo account expires—usually just as they’re starting to build confidence. Choosing a broker offering a longer or renewable demo period provides a valuable opportunity to learn and practise comfortably.

4. Trading Platform

One of the most critical aspects of picking a demo account is the quality and usability of the available trading platforms—an essential factor that can impact everything from trade execution to analysis and risk management.

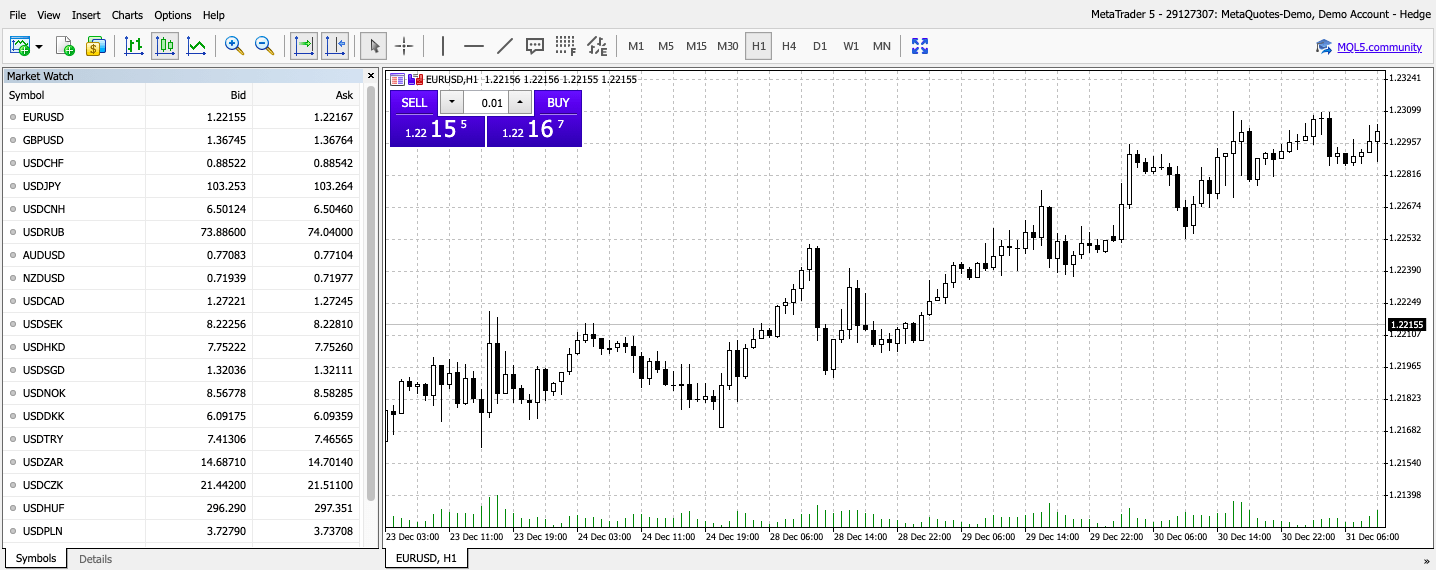

Most brokers offer access to the widely used MT4 and MT5 platforms in their demo accounts. These platforms are popular among more experienced traders for their custom indicators and automation features, but may feel outdated or overly complex for beginners.

Some brokers, however, limit demo account access exclusively to MT4, which might not appeal to newer investors or those who prefer platforms with a more modern design.

Others, like CMC Markets, offer their own proprietary web-based and third-party platforms, which allow you to choose a platform that best suits your preferences and trading style.

Additionally, it is essential to be aware of potential restrictions within demo environments. For instance, FxPro caps the number of open demo positions at 70 on MetaTrader accounts, which may limit strategy testing for more active traders.

On a more positive note, many brokers now offer fully functional mobile demo platforms. This is particularly useful if you prefer managing your investments on the go.

Many brokers limit demo trading to MT4 only, which may not suit beginners

5. Time To Sign Up

Once you’ve selected a broker, registering for a demo account is typically quick and straightforward.

Most platforms require minimal details—such as your name, email address, and country of residence—making it easy to start paper trading in just a few minutes.

However, some brokers request more extensive personal information, even at the demo stage. For example, during testing, FxPro asked for my date of birth, nationality, employment status, and level of trading experience – information more commonly associated with setting up a live account.

A few brokers go even further, requiring full identity verification, including proof of address and official documentation such as a passport, ID card, or residence permit.

While this level of scrutiny may be understandable if you’re planning to transition to a real-money account, it can be unnecessarily time-consuming and frankly irritating if you simply want to try out the platform risk-free.

You should also be aware that while demo accounts aren’t subject to FCA regulation like live accounts, some firms still apply strict onboarding procedures regardless.

Be wary about handing over your phone number to many demo account providers – you can end up getting a lot of phone calls (we know from personal experience!)

Signing up for many demo trading accounts has taught me that not all brokers make it easy – some let you in with just an email, while others treat it like applying for a mortgage.

If you’re just trying to test the waters, that extra admin can kill the momentum.

Pros and Cons Of Using Demo Accounts For Trading

Pros

- Trade without financial risk: Practice and improve your trading strategies using real-time market data, all without risking your own money.

- Hands-on market experience: Demo modes offer a more practical understanding of market behaviour than theoretical learning from books or webinars.

- Build confidence gradually: For cautious investors, demo accounts offer a low-pressure environment to get comfortable with online trading.

- Test-drive brokers: You can use demo accounts to explore a broker’s platform, available instruments, and customer support before committing any funds.

Cons

- Unrealistic expectations: Since demo accounts don’t involve real money, you don’t feel the psychological pressure of live trading, which can lead to overconfidence and unrealistic goals.

- Differences from real-world trading: Demo accounts do not replicate issues like trade execution delays, slippage, or liquidity problems, which can result in outcomes that differ from actual live trading conditions.

- Limited experience: We’ve found some brokers offer a less robust platform for demo trading, and not all provide access to the full variety of asset classes available in live accounts.

Bottom Line

Demo accounts are a valuable resource for investors at all levels. They allow beginners to build confidence by exploring the markets without risking real capital. They also allow more experienced traders to evaluate a broker’s platform, tools, and asset range before committing funds.

For UK investors, demo accounts can also help assess access to local markets—such as FTSE 100 stocks, GBP currency pairs, and FCA-compliant trading features.

That said, after opening hundreds of demo accounts and placing countless paper trades, we’ve learned they can vary widely in functionality, duration, available assets, and platform quality.

Explore our expert-reviewed list of the top-rated demo trading accounts for 2026 to find the best fit for your goals and trading style.

FAQ

Which Is The Best Demo Trading Account In The UK?

This will depend on the markets you want to trade, which platform you want to use, how much paper money you want to test strategies, how long you would like access to the paper trading mode, and how quickly you want to get started.

Use our ranking of the best demo accounts for UK investors to find the right provider for you.

What Is The Difference Between A Demo And Live Trading Account?

The main distinction between a demo and live trading account is that demo accounts operate in a simulated environment. While they mirror real market conditions—including live pricing and volatility—no actual money is involved, so there’s no financial risk or opportunity for real profit.

Unlike live accounts, demo platforms often come with certain restrictions. Most are available for a limited time, whereas live accounts can be used indefinitely as long as they’re funded and active.