Best Trading Apps in the UK 2025

Explore the best UK trading apps, informed by our years of personal experiences and feedback from millions of British investors on the App Store and Google Play. Many of our top apps cater specifically to British traders with convenient mobile deposits using GBP accounts and regulation from the Financial Conduct Authority (FCA).

Top Trading Apps In The UK

-

Pepperstone shines with top-tier integration with MT4, MT5, cTrader, and TradingView, ideal for traders using these major platforms. They offer stable mobile trading, boosted by Pepperstone's rapid execution speeds and extensive asset variety. It recently achieved second place in DayTrading.com's 2025 'Best Trading App' award.

iOS App Rating

Android App Rating

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Each year, XTB's app impresses with its sleek design and clear interface. It's fast, responsive, and full of practical features like integrated sentiment data, market news, economic calendars, and educational content. The intuitive order panel below the chart simplifies trade execution, including take profit and stop loss settings.

iOS App Rating

Android App Rating

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

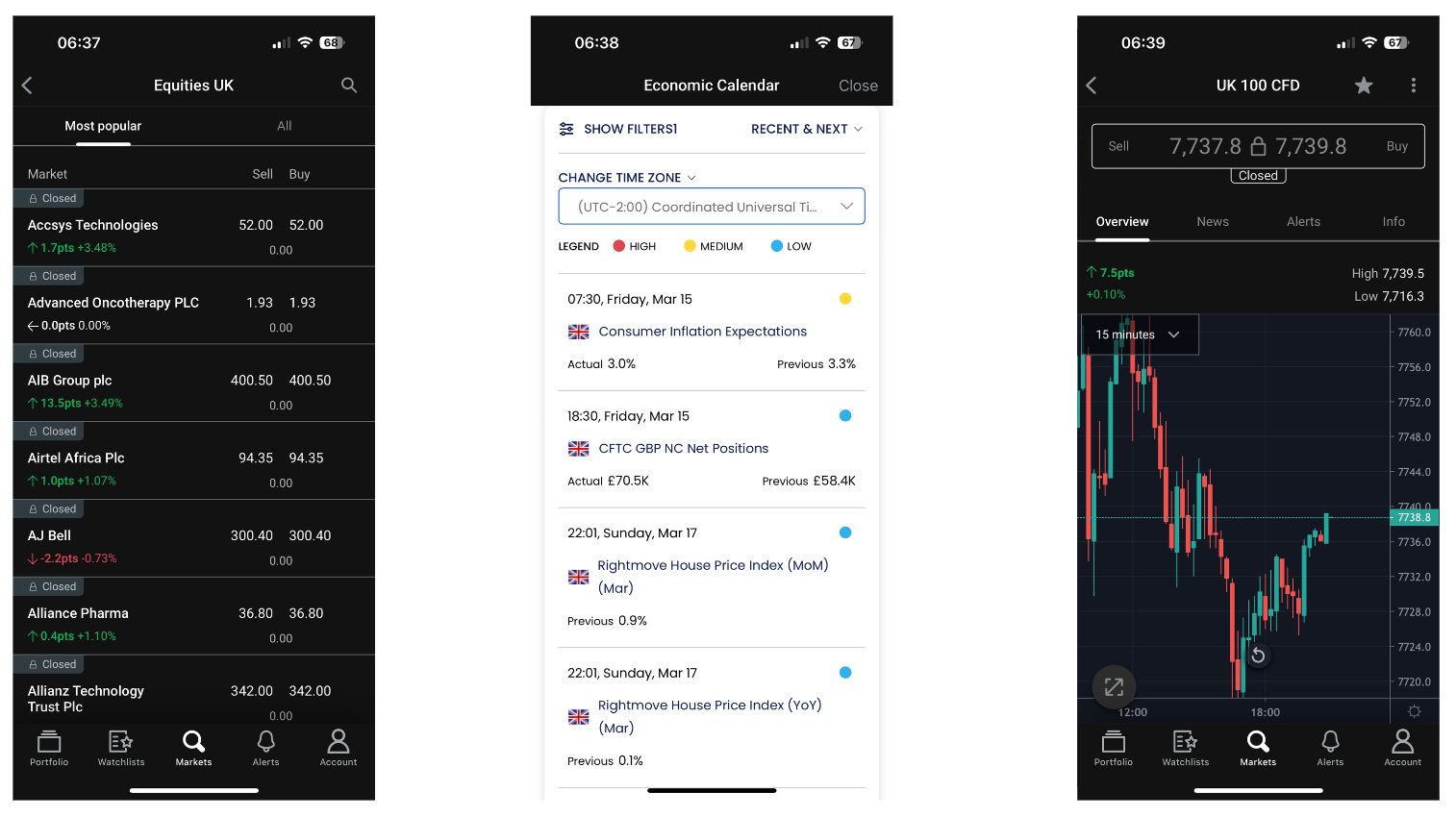

CMC Markets' award-winning app has revolutionised mobile trading. Its modern, customisable interface provides a unique user experience that sets it apart. Enhanced with 25 technical indicators, 15 drawing tools, and a swift, stable trading platform, it is an outstanding option for traders.

iOS App Rating

Android App Rating

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

FXCC enhances mobile trading via the MT4 app on iPhone, iPad, and Android, ideal for traders. The app boasts dependable, advanced charting with 30 indicators, 9 timeframes, and 3 chart types. With an FXCC account, traders can effortlessly start trading on the MT4 app in only three steps. Enjoy the convenience of trading over 70 currency pairs and other top markets anytime, anywhere.

iOS App Rating

Android App Rating

Instruments Regulator Platforms CFDs, Forex, Indices, Commodities, Crypto CySEC MT4, MT5 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

IC Markets provide mobile apps for their cTrader, MT4, MT5, and TradingView platforms. Developed separately for Android and iOS, these apps leverage each system's unique capabilities. Featuring raw pricing and spreads from 0.0, they offer superb tools for every trader level. What truly distinguishes them is maintaining IC Markets’ renowned rapid execution speed within the apps. This ensures a professional and highly responsive trading experience.

iOS App Rating

Android App Rating

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, FSA, CMA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

The FxPro app for iOS and Android, enhanced in 2024, exemplifies mobile trading with its intuitive design and robust capabilities. It allows traders to manage accounts, execute CFD trades, make seamless deposits and withdrawals, and access an integrated economic calendar with push notifications, all from the convenience of their device.

iOS App Rating

Android App Rating

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

IG provides an excellent trading app. As a mobile trading pioneer, it has evolved over the years into a top-tier app. Expect swift responses, an intuitive interface, comprehensive charting, and dependable performance. Additionally, it includes guaranteed stops, a crucial risk management feature absent in many apps we've evaluated.

iOS App Rating

Android App Rating

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro)

Safety Comparison

Compare how safe the Best Trading Apps in the UK 2025 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| IG Index | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Trading Apps in the UK 2025 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| IG Index | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Trading Apps in the UK 2025 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| CMC Markets | iOS & Android | ✘ | ||

| FXCC | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| FXPro | iOS & Android | ✘ | ||

| IG Index | iOS & Android | ✔ |

Beginners Comparison

Are the Best Trading Apps in the UK 2025 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| CMC Markets | ✔ | $0 | 0.01 Lots | ||

| FXCC | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| IG Index | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Trading Apps in the UK 2025 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| XTB | Open API | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IG Index | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✘ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Trading Apps in the UK 2025.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| CMC Markets | |||||||||

| FXCC | |||||||||

| IC Markets | |||||||||

| FXPro | |||||||||

| IG Index |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

Cons

- Despite broadening its market range, the crypto options remain limited compared to brokers like eToro, and there is no facility for investing in actual coins.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On XTB

"XTB emerges as an ideal option for novice traders, offering the impressive xStation platform, zero commission pricing, no required minimum deposit, and outstanding educational resources, many of which are conveniently integrated into the platform."

Pros

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- XTB offers a diverse range of over 7,000 instruments, including CFDs on shares, indices, ETFs, commodities, forex, and cryptocurrencies. The platform also provides real shares, real ETFs, share dealing, and the latest addition, Investment Plans, serving both traders seeking short-term gains and investors focused on long-term growth.

- XTB ensures swift access to funds, providing fast withdrawals with same-day payments for requests made before 1 pm.

Cons

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- CMC provides competitive pricing with narrow spreads and low trading fees, except for stock CFDs. The Alpha and Price+ programmes offer additional benefits for active traders, including discounts on spreads of up to 40%.

- The CMC web platform offers an exceptional user experience with sophisticated charting tools for trading and customisable options, suitable for both novice and seasoned traders. It supports MT4 but not MT5, and TradingView will be available from 2025.

- CMC Markets is well-regulated by respected financial authorities, ensuring a secure and reliable trading environment. It upholds a strong reputation, providing traders with confidence.

Cons

- Although there have been improvements, the online platform still needs further refinement to match the user-friendly trading experience offered by competitors such as IG.

- A monthly inactivity charge of $10 is imposed after a year's inactivity, potentially discouraging occasional traders.

- CMC provides a robust range of assets; however, it does not support trading actual stocks, and UK clients are unable to trade cryptocurrencies.

Our Take On FXCC

"FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account."

Pros

- There are no limitations on short-term trading techniques such as trading and scalping.

- FXCC offers competitive and transparent ECN spreads starting from 0.0 pips, with no commissions. This makes it one of the most cost-effective forex brokers available.

- There are no deposit fees other than standard cryptocurrency mining charges, which benefits active traders.

Cons

- Unaware traders might face steep withdrawal fees, such as a notable $45 for bank transfers.

- FXCC's exclusive MetaTrader platform is a limitation, especially when compared to more versatile options like AvaTrade, which offers five different platforms to cater to various trader needs.

- The range of research tools, such as Trading Central and Autochartist, is quite limited. Leading platforms in this category, like IG, offer more advanced features.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- In 2025, IC Markets earned DayTrading.com's accolade for 'Best MT4/MT5 Broker' due to its top-tier MetaTrader integration. This achievement highlights the broker's continuous refinement over the years to enhance the platform experience.

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

Cons

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

Cons

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

Our Take On IG Index

"IG offers a complete package with an intuitive online platform, top-tier beginner education, advanced charting tools through its TradingView integration, real-time data, and swift execution for seasoned traders."

Pros

- IG stands out with its extensive range of instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it has recently introduced US-listed futures and options, along with an AI Index. These options enhance opportunities for diversification in trading.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

Cons

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

When brokers rely on third-party apps like MT4 or MT5 instead of proprietary trading software, we’ve displayed those apps’ store ratings. Please note app store ratings may change.

Comparing Trading Apps

In recent years, we’ve seen a shift towards mobile investing, with trading app downloads in the UK doubling to 8.5 million from September 2020 to September 2023, according to Fintech Global.

Trading apps have also evolved. Gone are the days when you could simply buy and sell shares, the leading applications today cater to investors at every level with integrated research tools, price alerts, in-app support, and mobile wallet deposits.

Yet despite millions of pounds pouring into app development, the hallmarks of an exceptional trading app remain consistent:

We unpack our app testing methodology in more detail below.

They Are User-Friendly And Smooth To Operate

It’s key to choose an app that’s easy to use and navigate, focusing on smart decision-making amidst the growing number of applications in the UK introducing distractions like perks for frequent deposits, such as Stash.

Therefore, we rate online trading apps by their mix of helpful features against information overload and needless extras, only suggesting those that offer a superior mobile trading experience for investors of every level.

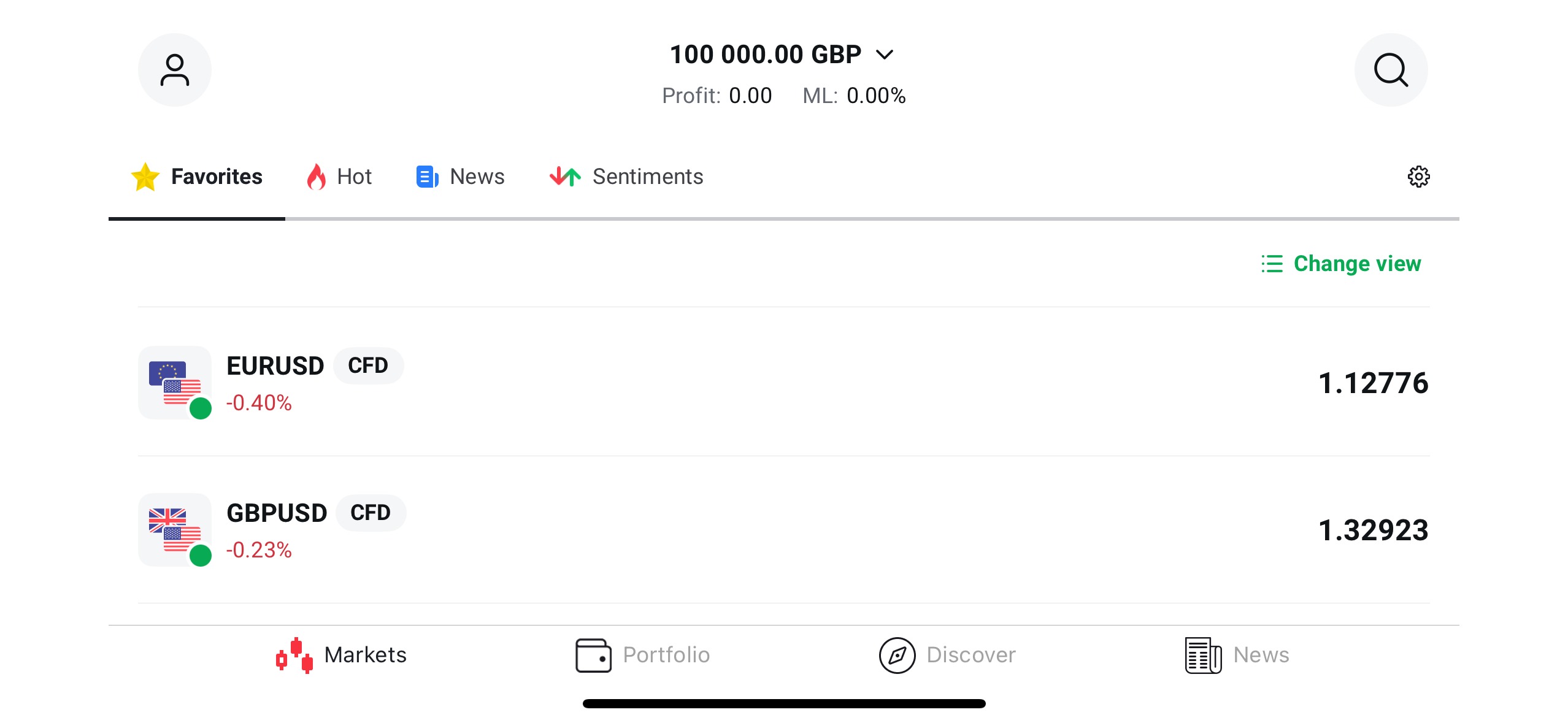

XTB iOS trading app

Use a demo account to make sure you find the trading app intuitive and easy to use before investing real money.

- XTB leads the pack with its mobile application, featuring a distinctive light design that makes trading on the go enjoyable. It offers easy access to charts, historical data, and news, while the bottom menu bar simplifies trade and account management, searching for instruments and managing your portfolio in a few taps.

They Have A Wide Investment Offering

Downloading an app that provides access to the markets you want to trade is essential. For UK traders, this could include shares on the London Stock Exchange, the FTSE 100 index, and currency pairs with the British Pound like the GBP/USD.

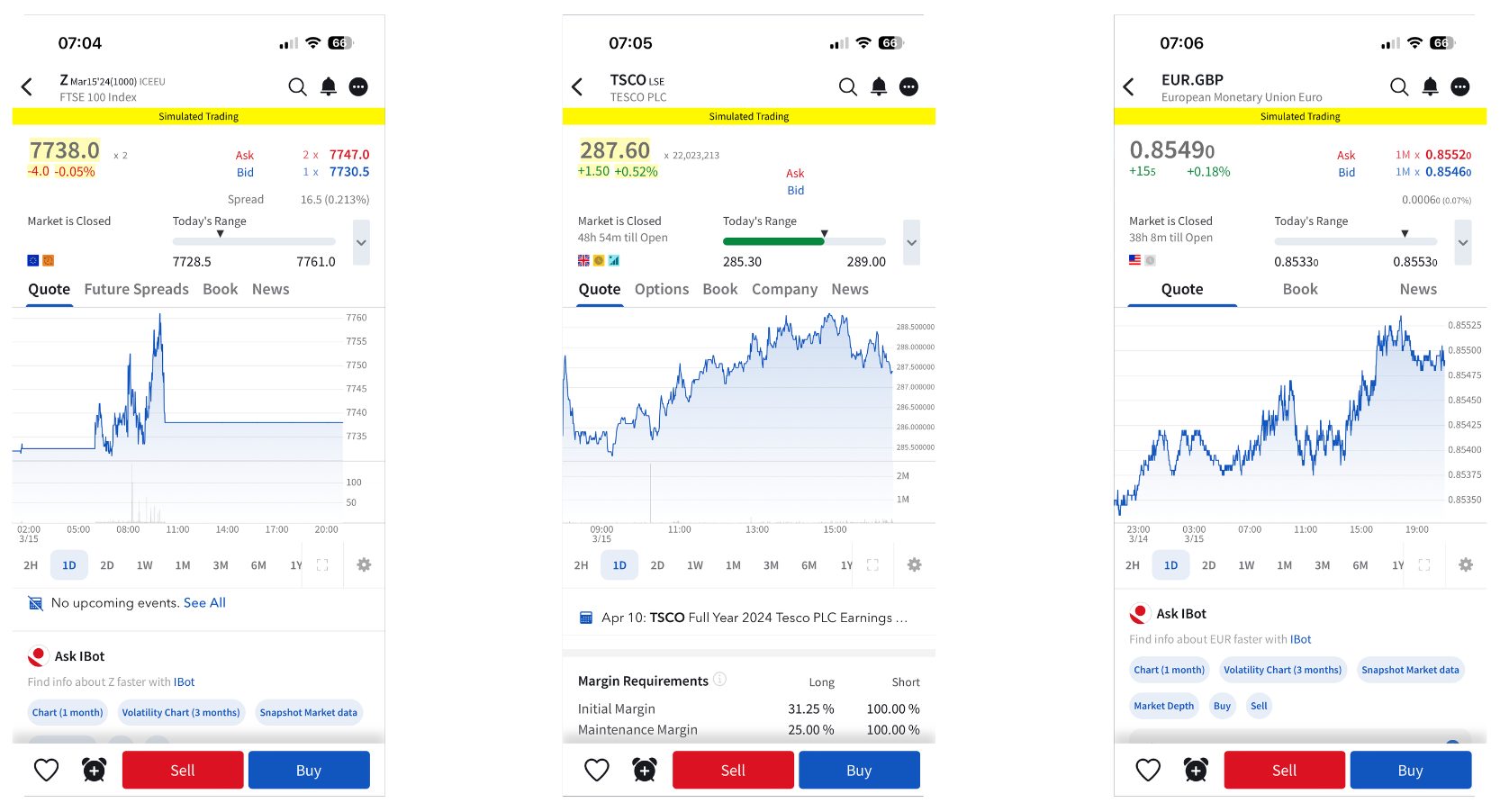

IBKR App

However, we also look for apps that provide access to a wide range of global markets, such as US, European, Asian and Australian equities, ensuring a diverse range of trading opportunities across different sectors and industries.

Moreover, we recognise the needs of different traders. Short-term traders may prefer platforms like CMC Markets for CFDs and spread betting in a fast and dependable app, while long-term investors might prefer XTB for share dealing and its new Investment Plans which are available exclusively in the app, and allow you to build tailored portfolios from 390 ETFs.

- Interactive Brokers offers a superior range of markets spanning 150 exchanges, including the UK. The IBKR mobile app also caters to an array of trading styles with fractional shares, stocks, ETFs, currencies, CFDs and even warrants and structured products.

They Offer Excellent Pricing

Choosing an app with low fees is crucial for both active and casual traders to maximise returns. That’s why we regularly assess fees across key markets like stocks, indices, commodities and cryptos to find low-cost apps for all types of traders.

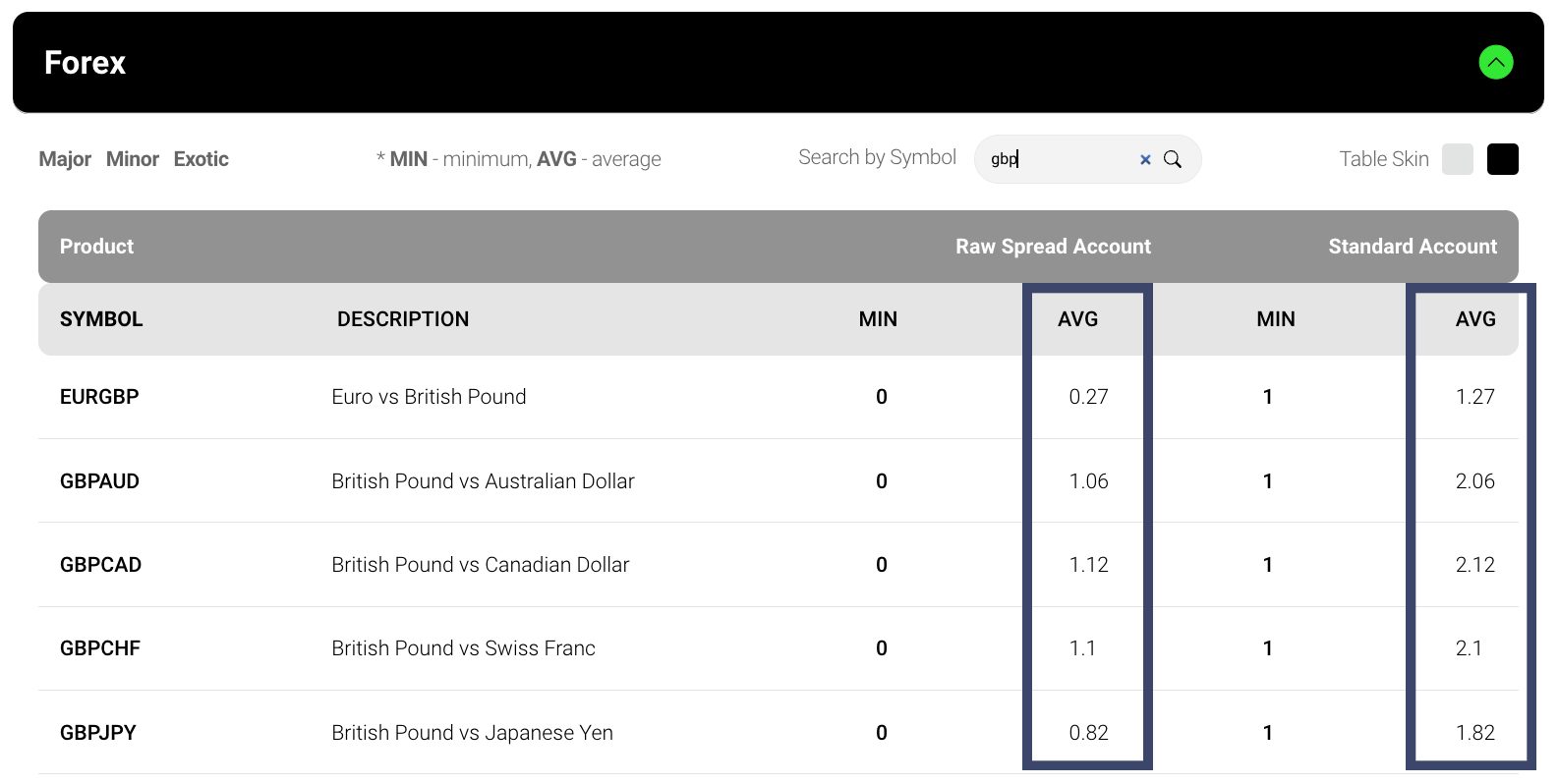

IC Markets Spreads

We also factor in the needs of different traders. For example, new stock investors might lean towards the increasing number of commission-free apps like XTB, which offer straightforward pricing with no deposit fees, whereas advanced forex traders may prefer Pepperstone with its Razor account that features raw spreads from 0.0 pips and a £2.25 commission per side, per lot.

- IC Markets is one of the lowest-cost investing apps in the UK, especially for active traders, with consistently tight average spreads of 0.1 on the EUR/USD and 1.0 on the FTSE 100. It also excels with rebates for high-volume traders and charges no fees for deposits or withdrawals.

They Provide Outstanding In-App Tools

Picking an app with intelligent tools to identify and capitalise on opportunities is crucial. Our years in the industry also show that mobile features are increasingly what sets a trading app apart.

As a result, we prioritise apps with essential tools like mobile-optimised charts with multiple indicators, drawing tools and timeframes, through to push notifications with price alerts, integrated signals and social investment networks so traders can share ideas on the go.

Forex.com App

It’s also an area brokers are focusing on. For example, XTB upgraded its xStation app in 2023, providing 5,400 instruments on mobile and tablet devices.

- Forex.com is hard to beat for tools with a clear investment in its app development. It now has it all, from market insights from its own analysts to integrated technical analysis from Trading Central, a stacked newsfeed, price alerts and economic calendars. It also outperforms MT4 in charting, boasting over 90 indicators and a superior design.

They Are Regulated In The UK

Opting for a trading app regulated by the Financial Conduct Authority (FCA) will provide the best safeguards for British investors, notably access to the Financial Services Compensation Scheme (FSCS) with coverage up to £85,000 if the firm goes bankrupt.

That’s why as part of our exhaustive reviews we check whether firms are regulated by the FCA or another reputable body.

IG FCA License

However, we also consider a firm’s years in the industry, whether they are listed on a stock exchange, and their reputation to determine whether they can be trusted.

For instance, both IG and Robinhood are FCA-regulated, but IG boasts over 30 years more experience, is listed on the London Stock Exchange, and has a fantastic reputation, contrasting with Robinhood’s controversial trading practices that have cost investors millions of pounds.

- IG consistently earns our recommendation as the UK’s most trusted trading app, licensed by the FCA and 12 other regulators. Our experts, active traders in the UK themselves, have used the IG app with real funds for years without major problems.

They Offer Convenient Deposits In The App

A smooth mobile trading experience hinges on secure and easy deposits and withdrawals directly via the app. That’s why our evaluations include investigating the availability of popular payment methods in the UK.

Over 50% of transactions in the country use debit and credit cards according to UK Finance, with Apple Pay and Google Pay leading as the top digital wallets increasingly accepted on trading apps, such as Plus500.

Select a trading app that offers a GBP account to simplify managing trades while minimising conversion fees.

FAQ

What Is A Trading App?

A trading app is a mobile application that can be downloaded to iOS and/or Android devices that enables trading on markets like the London Stock Exchange, FTSE, and GBP/USD. Besides executing orders, investment trading apps usually offer tools for market analysis and making deposits and withdrawals from your palm.

Some UK brokers like XTB have designed comprehensive proprietary apps, while others provide a number of specialised apps for forex and index trading, market news, and currency conversion.

Alternatively, many firms such as Eightcap in the UK, only support trading via popular third-party applications like MetaTrader 4 (MT4), MetaTrader 5 (MT5) or TradingView.

What Are The Most Popular Trading Apps In The UK?

The most popular trading apps in the UK based on download data from the app stores include Trading212 (10+ million), Webull (10+ million), TradingView (10+ million), MetaTrader 4 (10+ million), and MetaTrader 5 (10+ million).

What Is The Best App For Beginner Traders?

XTB continues to stand out as the best trading app for beginners. Our UK team’s real-money trading on the XTB app highlights its user-friendly design and valuable resources for new investors, including comprehensive educational videos, a £100,000 demo account, and rapid UK-based support with <2 minute response times during tests.

What Is The Best App For Experienced Traders?

IG maintains its position as the best app for experienced traders. Our UK experts, with years of real-money trading on the IG app, commend its first-rate mobile investing experience, featuring a nearly unrivalled selection of 17,000+ markets, customisable watchlists and feeds, plus the growing suite of research tools, most recently analysts’ consensus ratings on popular stocks.

How Do I Start Using A Trading App?

Once you have chosen a trading app, download it from the relevant app store. An increasing number of brokers, notably Interactive Brokers and City Index, host QR codes on their websites so installing their apps is a breeze.

Then open an account by providing your basic contact details and personal information. You’ll also normally need to verify your identity. Once your account is active, you can make a deposit (usually <£250) and start trading from your mobile.

Can I Trade Crypto On UK Trading Apps?

Some crypto exchanges have apps where you can buy and sell tokens like Bitcoin, the largest being Binance which has been downloaded 100+ million times.

However, the FCA brought in restrictions on the sale and distribution of retail crypto-derivatives on 6 January 2021. Since then, British investors have not been able to trade products like crypto CFDs unless they use apps from offshore, weakly regulated brokers.

Article Sources

Fintech Global – UK Trading App Download Data

Financial Conduct Authority (FCA)