Crypto Brokers

Crypto brokers connect UK traders with the $1 trillion digital asset market. The best cryptocurrency brokers offer a wide selection of coins with low fees, reliable platforms like MT4 or MT5, plus derivatives such as CFDs.

In this guide, we explain how crypto brokers work, from margin trading opportunities and UK regulations to the difference vs online exchanges. Our experts have also compiled a list of the safest cryptocurrency brokers in 2025.

Crypto Brokers UK

-

Traders can engage in the speculation of popular cryptocurrencies with commissions starting at just 0.05% and leverage reaching up to 1:200. Furthermore, the broker enhances its portfolio by launching crypto futures and hosting trading contests that offer tangible prizes.

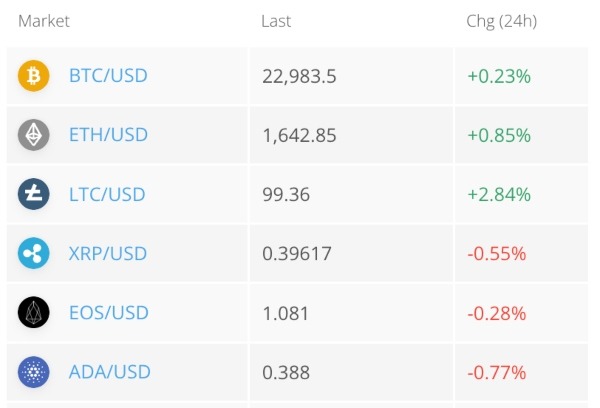

Crypto Coins

- BTC

- LTC

- ETH

- XRP

- EOS

- ADA

- DOT

- SOL

- UNI

- LINK

- DOGE

- BNB

- ICP

- SAND

- more

Crypto Spread Crypto Lending Platforms 0.05% BTC, 0.05% ETH No Own Crypto Staking Minimum Deposit Regulator No $0 -

IC Markets provides a range of over 20 cryptocurrencies for trading through CFDs, featuring less common tokens like Avalanche, Kusama, and Uniswap. Traders can enjoy commission-free transactions and experienced individuals can utilise high leverage up to 1:200 via the MetaTrader platforms.

Crypto Coins

- BTC

- BCH

- DOT

- DSH

- EMC

- EOS

- ETH

- LNK

- LTC

- NMC

- PPC

- XLM

- XRP

- ADA

- BNB

- DOG

- UNI

- XTZ

Crypto Spread Crypto Lending Platforms BTC 42.036 No MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Crypto Staking Minimum Deposit Regulator No $200 ASIC, CySEC, FSA, CMA -

OKX provides an excellent range of over 400 tokens, such as Bitcoin and Ripple. Traders can engage in buying and selling tokens or engage in crypto trading on margin through derivatives like perpetual swaps, options, and futures. The platform is distinguished by its competitive fees, wide token selection, and rapid transaction processing.

Crypto Coins

- BTC

- XCH

- ETH

- OKB

- OKT

- LTC

- DOT

- ADA

- DOGE

- XRP

- USDT

- ICP

- BCH

- LINK

- XLM

- ETC

- MATIC

- THETA

- UNI

- TRX

- EOS

- FIL

- XMR

- NEO

- USDC

- AAVE

- SHIB

- LUNA

- KSM

- BSC

Crypto Spread Crypto Lending Platforms Variable Yes AlgoTrader, Quantower Crypto Staking Minimum Deposit Regulator No 10 USDT VARA -

XTB provides a robust array of over 50 cryptocurrencies, featuring competitive spreads beginning at 0.22% on Bitcoin and leverage up to 1:5. The xStation platform facilitates trading with pairs like ETH/BTC and DSH/BTC. Traders can operate round-the-clock in a secure and transparent cryptocurrency trading environment.

Crypto Coins

- ADA

- BTC

- BCH

- DSH

- EOS

- ETH

- IOTA

- LTC

- NEO

- XRP

- XLM

- TRX

- XEM

- XLM

- XMR

- DOGE

- BNB

- LINK

- UNI

- DOT

- XTZ

Crypto Spread Crypto Lending Platforms 0.22% No xStation Crypto Staking Minimum Deposit Regulator No $0 FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti -

BitMEX provides an exceptionally competitive environment for crypto trading, offering low-cost $1 contracts and leverage up to 100:1. Its unique platform delivers advanced trading tools, featuring a customisable order book, a depth chart, and numerous technical indicators.

Crypto Coins

- BCH

- BTC

- ETH

- LTC

- XRP

- TRON

- EOS

- XMR

- ADA

- DOGE

- BNB

- DOT

- SOL

- SHIB

- AVAX

- GAL

- NEAR

- SUSHI

- AXS

Crypto Spread Crypto Lending Platforms -0.01% maker, 0.075% taker No BitMEX Web Platform, AlgoTrader, TradingView, Quantower Crypto Staking Minimum Deposit Regulator Yes $0.01 Republic of Seychelles -

With Uphold's user-friendly mobile app or web platform, you can trade over 250 crypto assets using fiat currencies or crypto pairs—offering more options than many competitors. Additionally, earn up to 16% APY by staking any of the 32 eligible tokens or transfer tokens to an external wallet.

Crypto Coins

- BTC

- BTCO

- AAVE

- ALCX

- DYDX

- INH

- XYO

- API3

- GHST

- LSK

- AUDIO

- GLMR

- NMR

- CAKE

- GODS

- REQ

- CHR

- TRB

- DAO

- ROOK

- XRP

- ETH

- BAT

- ADA

- ALGO

- ATOM

- AVAX

- AXS

- BCH

- BAL

Crypto Spread Crypto Lending Platforms Up to 1.5% No Desktop Platform, Mobile App Crypto Staking Minimum Deposit Regulator Yes $0 -

IQCent provides access to 17 cryptocurrency pairs via its own platform, featuring popular options like Bitcoin, Ethereum, and Litecoin. With crypto CFDs, leverage is limited to 1:10. Payouts for binary options differ by token yet stay competitive, with some OTC assets offering payouts as high as 95%.

Crypto Coins

- BTC

- ETH

- LTC

- ETC

- DOGE

- MATIC

- QNT

- SOL

- XRP

- USDT

- XMR

- BNB

Crypto Spread Crypto Lending Platforms Variable No Online Platform, TradingView Crypto Staking Minimum Deposit Regulator No $250 IFMRRC

Safety Comparison

Compare how safe the Crypto Brokers are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| PrimeXBT | ✘ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| OKX | ✘ | ✘ | ✘ | ✘ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| BitMEX | ✘ | ✘ | ✘ | ✘ | |

| Uphold | ✘ | ✘ | ✘ | ✘ | |

| IQCent | ✘ | ✘ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Crypto Brokers support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| PrimeXBT | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| OKX | ✔ | ✘ | ✔ | ✘ | ✘ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| BitMEX | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

| Uphold | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| IQCent | ✘ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Crypto Brokers at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| PrimeXBT | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| OKX | Android & iOS | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| BitMEX | iOS & Android | ✘ | ||

| Uphold | iOS & Android | ✘ | ||

| IQCent | iOS & Android | ✘ |

Beginners Comparison

Are the Crypto Brokers good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| PrimeXBT | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| OKX | ✔ | 10 USDT | Variable | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| BitMEX | ✔ | $0.01 | Variable | ||

| Uphold | ✔ | $0 | $1 | ||

| IQCent | ✔ | $250 | $0.01 |

Advanced Trading Comparison

Do the Crypto Brokers offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| PrimeXBT | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| OKX | ✔ | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| XTB | Open API | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| BitMEX | BitMEX Market Maker, BotVS, and via API | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Uphold | Automated crypto trading bots | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| IQCent | ✘ | ✘ | 1:500 | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Crypto Brokers.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| PrimeXBT | |||||||||

| IC Markets | |||||||||

| OKX | |||||||||

| XTB | |||||||||

| BitMEX | |||||||||

| Uphold | |||||||||

| IQCent |

Our Take On PrimeXBT

"PrimeXBT suits aspiring traders interested in crypto derivatives and traditional markets such as forex and indices, all accessible via a user-friendly, web-based platform. The copy trading feature is perfect for passive traders, offering 5-star ratings and performance charts to identify suitable traders."

Pros

- PrimeXBT offers ultra-fast execution speeds, averaging 7.12ms, making it an ideal choice for traders seeking optimal pricing during market volatility.

- The online platform and app cater to traders, offering advanced charts, a customisable interface, and multiple order options like one-cancels-the-other (OCO).

- Round-the-clock customer support, accessible through live chat, demonstrated outstanding performance during testing. Additionally, the comprehensive help centre offers ideal self-assistance resources.

Cons

- Despite enhancements, the range of approximately 100 instruments lags significantly behind competitors, such as OKX, which offers over 400 assets.

- PrimeXBT operates widely in the crypto sector but without approval from a recognised regulator, significantly increasing the risk for retail traders.

- The absence of integration with established platforms such as MT4 restricts traders accustomed to the globally popular forex software.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

- IC Markets provides reliable 24/5 support, especially for account and funding queries, drawing from direct experience.

Cons

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

Our Take On OKX

"OKX is ideal for traders seeking new crypto projects and emerging coins. They can utilise the platform's copy trading feature and automated bots."

Pros

- A vast array of blockchain products is available, featuring DeFi services, NFTs, and games, along with over 400 established and emerging cryptocurrencies.

- Active traders benefit from competitive rates, with maker fees starting at 0.02% and taker fees at 0.05%.

- Crypto staking and pools offer competitive mining fees starting at 2%.

Cons

- The firm has minimal regulatory oversight, which is typical for crypto brokers.

- Testing revealed that customer support quality varied.

- The broker's platform and features might feel intricate for beginners.

Our Take On XTB

"XTB emerges as an ideal option for novice traders, offering the impressive xStation platform, zero commission pricing, no required minimum deposit, and outstanding educational resources, many of which are conveniently integrated into the platform."

Pros

- XTB ensures swift access to funds, providing fast withdrawals with same-day payments for requests made before 1 pm.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB offers a diverse range of over 7,000 instruments, including CFDs on shares, indices, ETFs, commodities, forex, and cryptocurrencies. The platform also provides real shares, real ETFs, share dealing, and the latest addition, Investment Plans, serving both traders seeking short-term gains and investors focused on long-term growth.

Cons

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

Our Take On BitMEX

"Traders interested in a wide selection of crypto derivatives will find BitMEX appealing, especially with its Perpetual Contracts. Additionally, the 100x leverage on Bitcoin exceeds that of many other platforms."

Pros

- BitMEX consistently provides a wealth of free market insights, alongside trading guides and community platforms on Discord, Telegram, and additional channels.

- The BMEX token offers up to 15% discounts on trading fees and other exclusive benefits when staked.

- Traders can engage with investors through the intuitive chat feature integrated within the platform.

Cons

- Only Bitcoin is allowed for cost-free withdrawals.

- BitMEX primarily caters to active traders, offering limited tools and features for beginners.

- BitMEX operates as an offshore company and lacks regulation by any reputable authority, which is typical for crypto brokers.

Our Take On Uphold

"Uphold is a leading option for crypto investors seeking a comprehensive market access solution. It offers over 250 tokens for buying, selling, and trading through versatile platform features."

Pros

- Crypto staking is accessible for over 30 tokens, offering competitive rates reaching up to 16%.

- More than 250 cryptocurrencies are available, featuring leading tokens such as Bitcoin and Ethereum.

- The proprietary app is exceptionally user-friendly, featuring an elegant design and intuitive navigation.

Cons

- Uphold functions under minimal regulatory supervision.

- A 2.49% charge applies for credit or debit card usage.

- Customer service is sluggish according to assessments, offering few communication channels.

Our Take On IQCent

"IQCent attracts traders seeking a simple binary options and CFD platform with minimal fees, multiple accounts, and copy trading. Begin in under a minute with a $250 deposit."

Pros

- Enthusiastic traders may participate in competitions that offer cash prizes.

- The broker offers quick and dependable customer support around the clock, usually responding in under a minute during tests.

- New traders with a modest budget can start trading with a minimal stake of just $0.01.

Cons

- The broker operates without oversight from a reputable regulator, which is typical for binary options companies.

- The market analysis provides only fundamental details, offering limited technical summaries and insights from analysts.

- IQCent imposes a £10 monthly inactivity fee if a trader does not execute at least one trade each month.

How Crypto Brokers Works

Cryptocurrencies are a type of digital asset that are usually bought and sold on a blockchain – a decentralised public ledger that records transactions across a network of computers. Crypto assets are known today for their eye-watering returns on investment – the original cryptocurrency, Bitcoin, went from being worth pennies at its inception to an all-time high above $69,000 (£51,000) in November 2021.

But they are also known for being risky investments, both because of their extreme price volatility and the prevalence of scams and collapsed projects in this largely unregulated world.

At the most basic level, crypto brokers act as mediators between retail traders and cryptocurrency markets. They serve as a channel through which retail traders can purchase digital assets, or they may offer derivative products such as CFD crypto trading, that allow investors to speculate on token prices without actually owning and storing the coins themselves.

Crypto Brokers Vs Exchanges

At the outset, the only way to acquire cryptocurrencies was to mine them or reach an agreement with a seller and conduct a peer-to-peer transfer. Crypto exchanges solved this problem by creating an online marketplace where orders could be placed and filled, allowing for real-time transactions in the same vein as a traditional stock exchange.

Crypto exchanges are the most popular way to buy digital assets today, and some including market leader Coinbase offer derivative products, decentralised finance support and other features. However, the downside of exchanges is that they come with inherent risk – crypto assets are largely unregulated, any assets you have on an exchange are no longer in your custody, and if the exchange fails you risk losing everything. Even some of the largest exchanges – such as FTX in 2022 – have been led to ruin by poor management or unscrupulous practices, leaving clients with losses worth many millions of pounds.

Online brokers are generally a safer way to get involved in the crypto market, since many are overseen by reputable regulators and have a track record of offering legitimate investing products to aspiring traders. Any broker regulated by the UK’s Financial Conduct Authority (FCA), for example, is legally obligated to segregate clients’ funds in a separate bank account and provide negative balance protection, among other measures designed to lower the risk of clients losing their funds.

Additionally, crypto brokers in the UK usually offer a long list of other tradable instruments in various asset classes, from stocks to forex and commodities. This means they are less exposed to the volatility of the crypto market, and less likely to collapse if there is a drastic crash or an unexpected rally.

The availability of derivative products at crypto brokerage firms is another big advantage for traders. With products like CFDs, spread betting and binary options, retail traders can speculate on price movements without the hassle involved in actually buying, storing and selling digital assets.

Although regulated brokers in the UK are not permitted to offer margin on cryptocurrency derivatives, it is available from some crypto brokers in different regulatory jurisdictions, including the European Union and United States.

How To Compare Cryptocurrency Brokers

Choosing the right broker gives traders the best chance to capitalise on crypto’s profit potential. Every trader has their own needs and preferences, but there are some general points to consider when comparing the best crypto brokers:

Range Of Coins

Bitcoin, Ethereum, Litecoin and other well-known tokens are now offered by a variety of online brokers, but traders who are clued up on crypto investing may want a brokerage with more choice.

Generally, brokers will only offer a coin or token that is reasonably well established, so it is unlikely you will be able to trade the latest meme coins before they go on a big run. However, there are some crypto brokers that will support a wider range of digital assets, including Cardano, Dogecoin, Polkadot and more.

Crypto Tokens – PrimeXBT

Also look out for the different asset classes offered by crypto brokers – they will often offer stocks, forex, commodities, and ETFs among others. Importantly, this means more opportunities to build a diverse investment portfolio.

Trading Vehicles

One of the most important things to consider in a crypto broker is the investing products that will be available to you. Retail traders will often have a choice between a few derivatives:

- CFDs – Contracts for difference, or CFDs, are an agreement between broker and customer that allows the trader to bet on the price movement of an asset. If the trader’s prediction comes through, they will earn the difference between the asset’s price at the start and end of the contract; if the price moves against them they will need to pay the difference.

- Spread betting – Traders can use spread betting to speculate on whether crypto prices will rise or fall in a similar way to CFDs. The profit (or loss) is determined by the extent that the spread moves past the token’s price when the contract begins. Profits from spread betting are also usually free from tax in the UK.

- Binary options – These derivatives are popular among retail traders because they are simple – the contract’s length, price, potential loss and profit are all determined before the contract begins, and the trader only needs to correctly guess whether the cryptocurrency’s price will go up or down.

Bear in mind that since the FCA’s 2021 ban on margin trading cryptocurrencies, brokers in the UK are less likely to offer all of these products. However, if you are registered with a broker in some EU countries or elsewhere, you should be able to trade crypto derivatives through popular brokers without restrictions.

Fees

Traders should consider a broker’s pricing structure to get an idea of how much they will need to pay per trade.

Crypto brokers will often charge a commission per trade – eToro, for example, charges 1% for crypto trades, though there are also brokers with a lower percentage or 0% commissions.

Another way crypto brokers earn is through the spread – essentially, they pay traders less for an asset than they sell it for. Cryptocurrency brokers may earn both from a spread and commission fees, or they may advertise as a no-commission brokerage and earn solely from the spread.

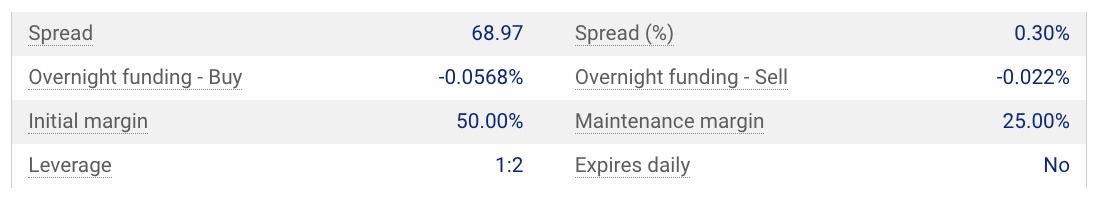

BTC/USD CFD Fees – Plus500

It is also worth checking the top crypto brokers for details on any additional charges for deposits and withdrawals, account maintenance, and inactivity.

Importantly, the best crypto brokers will be transparent about pricing, so be wary if their fee schedule is hidden or if it does not include key information.

Platforms

Some crypto brokers have proprietary platforms that work through a browser or app, others allow traders to use third-party software such as TradingView, MetaTrader 4 (MT4), or MetaTrader 5 (MT5).

Beginners may wish to start with a simple browser-based platform, but many traders prefer the power and flexibility of a platform like MT4, which is home to customisable charts and graphs, plus a suite of technical indicators and order types.

Also check that the broker’s desktop platform is available on mobile and tablet devices, with mobile-optimised features and seamless integration.

Regulation

The UK is home to several reputable crypto brokers which are regulated by the FCA. However, since the regulator banned crypto derivatives for the retail market in 2021, the choice is fairly limited for non-professional traders.

UK investors who want to benefit from a cryptocurrency broker may be able to set up an account with a brokerage based abroad. Trusted foreign regulators include Cyprus’s CySEC, Australia’s ASIC, plus the SEC and FINRA in the United States.

Payment Methods

The payment methods accepted by a broker can make a big difference as certain methods can be expensive, slow or otherwise impractical. Most brokers accept debit/credit card payments and bank transfers, but there are many that accept PayPal and other e-wallets.

The top crypto brokers also offer deposits and withdrawals via popular digital assets like Bitcoin, Ethereum and Tether. This can make it easier to both fund and trade in your favoured cryptocurrencies.

Also take note of any minimum deposit requirements. The best crypto brokers in the UK will offer a low minimum deposit of <£200 for beginners.

Security

Make sure that your crypto broker uses up-to-date security measures. Good safety features to look for include secure protocols on their website and payment gateway, two-factor authentication and voice/face recognition on their mobile app.

Legitimacy and reliability is a key difference between many crypto brokers and exchanges. While high-profile exchanges have been plagued with accusations of financial mismanagement and even fraud, major crypto brokers typically have a long track record of serving retail clients with robust accounting processes and third-party audits.

Customer Support

A quick and responsive customer support department can be the difference between a good and a great online broker.

Ideally, your cryptocurrency broker should have a live chat function available 24/7 and a phone hotline. Additionally, many leading crypto brokers now offer customer support through popular social media channels.

Additional Tools

Copy trading, in particular, can be a good way for rookie or time-poor traders to benefit from the expertise of experienced investors.

Crypto brokers such as PrimeXBT offer this service, which allows you to search out and select a trader whose profile and strategy match your requirements. Invest your chosen amount in the trader and automatically mirror their trades in your own account.

Other useful tools include support for automated algorithms and bots, signals, advanced charts and market analysis.

Educational Resources

Some crypto brokers provide beginner-friendly educational resources, including blogs, videos and even live seminars.

These are invaluable to newer traders as they provide a good framework to learn the fundamental facets of investing in cryptocurrencies, including technical analysis and risk management.

Bottom Line On Crypto Brokers

Crypto brokers are a great way for British traders to invest in cryptocurrency markets while mitigating some of the biggest risks of other avenues, such as exchanges. As well as allowing traders to speculate on leading coins and tokens, they also offer educational resources, benefits such as social investing, and margin on derivative products.

Use our ranking of the best crypto brokers for UK traders to get started.

FAQ

What Are Crypto Brokers?

Crypto brokers allow traders to speculate on the price movements of popular cryptocurrencies, such as Bitcoin. Some brokers will simply act as middlemen, purchasing and holding tokens for traders who place orders. Others also offer derivative products like CFDs, which allow traders to speculate on the price movements of cryptocurrencies without buying them.

What Are The Best Crypto Brokers?

The question of which crypto broker is best depends on how you want to trade, which platforms you prefer and a range of other factors. Some traders will look for crypto brokers that offer the most coins and tokens, while others will want to trade a specific cryptocurrency with the lowest fees.

In Britain, online brokers are somewhat limited by government regulations banning crypto derivatives for the retail market, but IC Markets provides one of the most popular crypto brokerage services to UK clients. The best crypto brokers regulated in Australia, parts of Europe and the US also offer leverage trading to retail clients, and they may allow UK traders to register.

Use our cryptocurrency brokers list to compare the top operators that accept traders from the UK.

How Do Cryptocurrency Brokers Work?

Online crypto brokers often act as mediators between registered traders and digital currency markets. Traders place orders for cryptocurrencies and the broker will purchase and store them safely for clients.

Many of the biggest crypto brokers also offer CFDs and other derivative products that allow traders to speculate on price movements without actually buying and storing the underlying coins.

Are Crypto Brokers Regulated In The UK?

The best crypto brokers are regulated, reliable and legit, with oversight from organisations like the FCA, CySEC, and ASIC. This means clients of major crypto brokers can rest assured their funds will be relatively safe from the kind of scandals and bankruptcies that have plagued crypto exchanges.

Always carefully research a crypto broker online by checking for its regulatory oversight, as well as reading reviews and user comments, before signing up.

What Are The Largest Crypto Brokers?

In the UK, some of the largest crypto brokers that accept retail clients include XTB and Plus500. Many of the other big brokers in the UK limit their cryptocurrency derivatives to professional traders due to FCA regulations. However, crypto derivatives are available from some of the biggest online brokers in different jurisdictions around the world, including the EU, USA and Australia.