Gold or Silver?

Many investors looking at precious metals as a diversifying or speculative investment will think about investing in either gold or silver. Certainly there reasons for purchasing both, and an exposure to gold and silver can be achieved in much the same way: directly through the purchase of bullion products or coins, or through investment into ETFs, shares of mining companies, or futures and options.

For an investor who wishes to hold physical gold, there are considerations over storage, and perhaps whether to hold gold in allocated or unallocated accounts. There is a lot to think about before buying gold, and perhaps included should be a comparison to silver. The final decision as to whether to invest in gold or silver may be dictated by the economic cycle as much as the individual qualities of the two metals.

Qualities compared

Gold is a dense metal with a high lustre and attractive yellow colour. It is a bright metal, which has a high durability – it does not tarnish – and is very malleable. It is found in its pure form on and below the earth’s crust. It is also an efficient electrical conductor.

Like gold, silver has a lustrous quality, though it is white in colour. Silver is a ductile metal, malleable like gold, though silver does tarnish over time. It is one of the best electrical conductors known to man. Silver is most commonly found in nature as an alloy with other metals such as copper.

Uses of Gold and Silver

Jewellery

The first use of both metals that comes to mind is as jewellery. Both are decorative metals, and have been used throughout history in the manufacture of rings, earrings, bracelets, chains, etc. However, even though both metals have a high durability, and are malleable – perfect for forming intricate items of jewellery – gold is alloyed with other metals, such as silver and copper, when used for jewellery to increase its hardness. Silver jewellery tends to have a higher concentration of silver in its alloys.

Financial

Both metals have been used as a form of currency, and then in the minting of coins for standardised transactions in global trade. The Mesopotamians produced silver and gold coins as early as around 700 BC, and both metals were used in the minting of coinage until the 20th century. Even now, some coins will be produced in pure silver and pure gold, though these are for investment purposes rather than as circulated currency.

With the higher value of gold, coins intended for the purchase of goods and services ceased to be made of the yellow metal a long time before silver content was cut.

However, both gold and silver, because of their values as precious metals, can be used as a currency substitute, and the use of such ‘digital gold or silver’ is becoming more popular.

Medicinal

Both gold and silver are used in dentistry and medicine.

Gold is used for a variety of treatments such as rheumatoid arthritis, and is used in the treatment of some cancers and neurological disorders. It also helps to control addictions to caffeine, nicotine, and alcohol.

Silver is used in the production of antiseptics, and treatments for dermatological diseases. It is used in dressings for external wounds, as well as in treatments for pneumonia, some cancers, HIV/ AIDS, and herpes.

Industrial

Gold is an efficient conductor and is used as electrical conductors and connectors, particularly where small parts are required such as in cell phones, gps equipment, calculators, and televisions. It is also used in large amounts in the aerospace industry, where its qualities as both a conductor and reflector are important in the manufacture of components and casings for air and space travel and exploration.

Silver is used in many industries. Its uses include electrical equipment, hi-fi, batteries, photographic applications, electrical connectors and conductors, nuclear reactors, computers and other equipment that requires small conductive parts. In fact, because of its wide ranging uses in the manufacture of goods, silver is sometimes looked upon as an industrial metal rather than a precious metal.

World Production

In 2011, global gold production reached 2700 tonnes. According to the World Gold Council, the world’s top producer was China, at 355 tonnes, with Australia’s 270 tonnes putting it in second place. The USA was the world’s third largest producer at 237 tonnes.

Silver production outstripped gold by 10:1. At 23689 tonnes, world silver production boomed in 2011 as the economies of China and India pulled in silver for use in its growing industrial sectors. The world’s largest silver producer in 2011 was Mexico, at 153 million ounces, with China lagging in third position at 104 million ounces.

So what does all this mean?

Both gold and silver are used more extensively than many people realise. Silver is accepted as a mainstay in the sectors of financial and jewellery use, especially because it is seen as a cheap alternative to gold. Gold and silver are also commonly used for awards, cups, medals, and trophies.

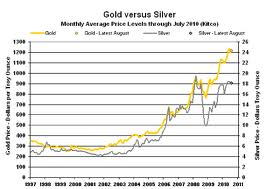

However, gold has a tradition as a currency metal that is unrivalled. Its production is lower than that of silver, and it value per ounce far higher. Historically the ratio between the price of gold and silver is around 15:1. This ratio fluctuates, and understanding why may lead to better timing of investment decisions.

As a metal used in industry, silver wins hands down. Both silver and gold are seen as investments to hedge against inflation and as a store of wealth, though gold tends to outperform silver when economies falter and political climates erupt. When industrial production increases, and economies are growing, the growth in the demand for silver tends to outstrip that of gold.