Cyclical and Defensive Stocks

Economies move in cycles. They expand, to a point where they overheat and inflation may get out of control, and then they cool down, most commonly to standstill or contraction. Growth and recession seems to be part of the modern world, and is most commonly measured by reference to the Gross Domestic Product (GDP) of a nation.

The GDP is the value of all goods and services within an economy, and can be measured in a simple form by adding up everyone’s income or spending (logically these two should be equal, but spending on credit distorts these numbers). GDP is usually measured on an annual basis, and then announced in terms of percentage change from the previous quarter and the previous year.

At the top of the economic cycle, most money is being spent. But spending habits change through an economic cycle. When times are good, consumers will buy more of what they want, and when times are bad this spending becomes restricted to necessary items. In other words, discretionary spending increases as the economy improves and peaks at the top of the cycle whilst necessary spending is likely to remain fairly constant throughout.

It is the economic cycle and our habits as consumers that define the difference between cyclical and defensive stocks.

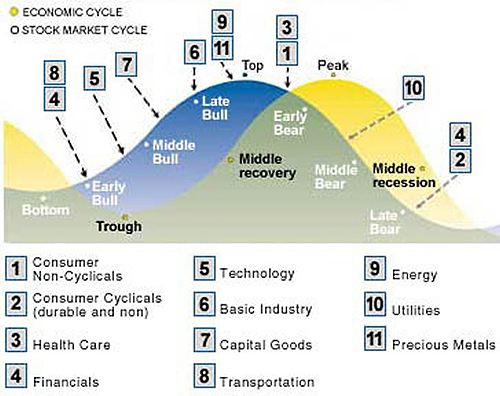

Cyclical stocks are likely to outperform defensive stocks as the economy is improving and while it is operating at peak, while defensive stocks are likely to outperform cyclical stocks when the top of the economic cycle has passed and through the recessionary phase.

Top Stock Brokers UK

-

IG offers 13,000+ shares to trade or invest in, with more listed firms than nearly every competitor. The broker also excels for its zero commissions on US shares, while out-of-hours trading provides access to 70+ shares, plus popular ETFs and trusts, when the markets are closed.

-

You can trade a dozen major indices, including the Dow Jones, NASDAQ and S&P 500 with competitive spreads at FXCC. However, it’s disappointing that FXCC doesn’t offer any individual stocks - a huge drawback against competitors like CMC Markets, which offers thousands of shares.

-

RoboForex provides one of the broadest selections of real equities and stock CFDs spanning the US and 14 regional European markets, including direct access to the NASDAQ. It’s also one of the few brokers to offer a dedicated platform for stock trading, sporting leverage up to 1:20 and a robot builder that enables traders to automate and backtest stock trading strategies.

-

There are hundreds of major global shares and indices available. You can also trade IPO shares and ETFs in the MT4 platform, depending on jurisdiction. You can expect a reasonable 0.1% commission on US shares, plus a range of analysis features to help you stay ahead of stock market news.

-

FOREX.com provides access to a wide array of US, EU, and UK stock CFDs, featuring spreads as narrow as 1 point. This enables you to speculate on established household names and emerging IPOs, fostering ample opportunities for diversification within stock portfolios. US stocks are accessible from as low as 1.8 cents per share.

-

Eightcap offers 590+ US, Australian, and European shares as well as a modest range of indices, including the Dow Jones and FTSE. Its Labs offer excellent educational tools, notably the ‘Navigating Stock Market Volatility’ guide, while Capitalise.ai lets you automate stock trading strategies in plain English. On the downside, Eightcap still doesn’t offer fractional shares for budget traders, which are available at brokers like XTB.

-

OANDA expanded its suite of stocks in 2024 with more than 2,200 shares now available from leading stock exchanges, including blue chip firms like Apple and Meta. There are also no commissions on US stocks and traders benefit from free insights and market reports from Dow Jones and Oanda’s MarketPulse research tool.

-

eToro offers access to thousands of stocks and shares from all over Europe, the US and beyond, with new opportunities on Dubai's top stocks added in 2024. Traders can invest alone or join millions of other traders in eToro's popular social trading community. Buy-and-hold investors can also try out the broker's Smart Portfolios, covering exciting thematic collections like Big Tech.

-

FxPro offers hundreds of stocks and ETFs from major economies including the US, UK, France and Germany, with access to high-quality research resources. The broker also continues to expand its financial services through its BnkPro e-money and investment products.

-

City Index offers thousands of global shares via CFDs and spread bets. Pre-market and after-hours trading is also available on 70+ US stocks, including Tesla and Apple.

-

Plus500 continues to offer an extensive range of shares across UK, US, and European markets via CFDs. The ESG and cannabis sector opportunities are also enticing features not commonly found among other platforms. There also an impressive 30+ indices available with leverage up to 1:20.

-

You can trade a decent range of US and European share CFDs, with 1:5 leverage. There’s also a competitive choice of ETFs and indices across the three available platforms. It’s easy to stay updated with the stock market using the broker’s customizable trading alerts and the in-platform news feed.

-

You can trade over 100 US, UK, European and Hong Kong stocks via CFDs, which is a more diverse selection than some top competitors. The broker also offers the popular Autochartist market scanning tool which continuously uncovers stock market signals.

-

IBKR provides access to an unparalleled array of equity products originating from 24 diverse countries. Whether seeking capital appreciation, dividends, or voting rights, you can directly invest in stocks. Alternatively, you can engage in speculative trading on price movements through CFDs, futures and more than 13,000 ETFs. IBKR also enhanced its European equity derivatives offering in 2024 by adding trading on CBOE Europe Derivatives (CEDX).

-

Trade binary options and CFDs on global stocks from US, European, Russian and Asian exchanges, as well as 37 indices covering a wide range of global markets. The access to stocks trumps many binary options brokers.

-

CMC provides opportunities on over 10,000 stock CFDs and offers reliable support during market hours based on tests. You also gain complimentary access to new and excellent analysis from reputable third-party outlets. On the downside, there’s no trading in real stocks in some countries.

-

IC Markets offers access to 2,100+ stocks from Australian and US markets - NASDAQ, NYSE and ASX. You can choose between 4 platforms, though cTrader excels for seasoned stock traders looking for the widest range of indicators, timeframes and chart types. Over 25 indices also provide exposure to diverse regions and economies.

-

Focus Option traders can access 21 global stocks via high/low binary options through a web-based platform or CFDs via a mobile app. This includes big firms like IBM, Tesla and Microsoft.

-

You can trade an excellent suite of 2000+ US stocks, fractional shares, options, ETFs, OTC and ADRs. There are no commissions on most assets. Additionally, extended hours trading is offered as well as optimized screeners and custom watchlists to aid investment decisions.

-

OspreyFX offers leveraged trading on US and European stocks and shares. There are no restrictions on strategies and traders benefit from competitive, real-time pricing and access to industry-leading software from MetaTrader.

-

Invest in over 40,000 US, UK and international stocks from 17 leading exchanges. The selection of shares beats most competitors while prices are fixed and transparent.

-

Trade 25+ global stocks with CFDs commission-free with fast execution and STP pricing. This is a narrow selection vs competitors, focussed on US markets. Eight indices are also available to speculate on the movements of US, European, UK and Australian markets.

-

Errante offers CFDs on 58 stocks of some of the world's largest companies. Trade big names like Alibaba, Amazon and Apple with low fees. Traders also benefit from top-tier liquidity and fast execution, but note that as these are CFDs, you cannot buy and own physical shares.

-

Clients get commission-free exposure to US, EU, Asian and Russian stock markets on both the MT4 and MT5 platforms. Traders can also save time by utilizing the automated stock market insights in the AutoChartist scanning tool.

-

Coinexx traders can speculate on broad movements of global markets via five indices covering exchanges in the US, UK, Germany, and China. On the downside, there are no individual stocks which is a significant drawback.

-

You can trade a decent range of CFD shares from US, UK and EU markets, as well as 40+ ETFs and a variety of indices. US stocks are commission-free and you can get started with just a $100 minimum deposit. That said, it’s disappointing that there’s no stock market analysis on offer.

-

Trade CFDs on 25 global stocks including Alibaba, Netflix and Tesla. This is a very limited selection, but traders can also make highly leveraged bets on 18 indices covering a wide range of global countries and regions including the US, Europe, Russia, China and Japan.

-

A small selection of 100+ popular international stocks is available. Trading is available on the MT5 platform, which delivers reliable stock market news straight to your dashboard. That said, it’s disappointing that the broker doesn’t provide any additional research tools.

-

Access a modest selection of 60+ US and European company stocks including Amazon and Volkswagen. Major global indices like the S&P 500 and FTSE 100 are also available. Stock traders can enjoy convenient access to the MT4 platform via desktop, web browser and mobile.

-

Firstrade offers commission-free stock trading on the NASDAQ, NYSE and OTC markets. Clients can invest in penny stocks through to blue chip stocks with extended hours trading, plus conditional orders and trailing stops. We also rated the dividend reinvestment program.

-

World Forex traders can speculate on price movements of 40+ stocks with CFDs and digital contracts with no commissions, tight spreads and high payouts. You can take positions on big names like IBM and American Express.

-

With 300+ stock CFDs from a variety of global exchanges, traders can choose between some of the world's biggest blue chip companies. FinPros charges no commission fees for shares trading, making this a competitive offering although not as diverse as some alternatives.

-

Traders can speculate on broad stock market movements by trading on 14 major indices, including the FTSE 100, S&P 500 and Dax 30. Clients can analyze stock market movements on leading trading software from MetaQuotes.

-

Trade CFDs on 134 high-market-cap US and global stocks including Alibaba, Microsoft and Pfizer. You can also speculate on broader market movements through 35 indices covering major global exchanges.

-

Take positions on major brands in multiple industries, from finance to manufacturing and technology. Popular indices like the Dow Jones also offer more diverse access to popular markets.

-

Zacks Trade offers a large selection of US and international stocks, including penny stocks, as well as ETFs and global indices. The broker also offers options as a way to speculate on stock price movements.

-

Buy and own thousands of shares commission-free, including blue chip companies like Apple and Microsoft from the NYSE and NASDAQ exchanges. Fractional shares also allow investments from as little as $1, which will appeal to beginners and those on a budget.

-

Scope Markets offers stock trading on 1500+ popular markets, as well as a decent range of cash and futures indices. Traders looking to diversify can explore some other interesting opportunities, like cannabis stocks. There are also some useful resources to help inform trading decisions, including a dividend calendar.

-

Traders who sign up to TMGM's IRESS account can access the broker's vast selection of around 10,000 stock CFDs, sourced from 12 global exchanges in the US, UK, Australia, EU, Hong Kong and Japan. This is one of the best ranges of equities of any CFD broker.

-

Anzo Capital traders can trade 30 US and European company stocks as well as several stock indices. Trading is done through CFDs, meaning traders do not own the underlying asset and can bet on rising and falling prices.

-

That said, I find the range of just 86 shares products is very limited compared to most other brands. The good news is that spreads are pretty competitive, coming in at around 0.11 for the Twitter (X) stock.

-

Rock Global traders can either trade company shares directly or speculate on stock markets via CFDs. The broker covers an excellent range of markets spanning Asia-Pacific, North America and Europe. Brokerage fees start at $9.95 for US shares.

-

Traders can access an excellent choice of 800+ share CFDs with up to 1:20 leverage and the option to trade with zero commission. The diverse selection covers US, EU, UK and HK exchanges, which should offer plenty of opportunities for more experienced investors.

-

Pocket Option continues to trail alternatives in the stock department with just several dozen of the most popular shares like Microsoft and Google. That said, the payouts are competitive on stocks reaching 92% while indices offer an alternative way to speculate on stock markets with returns up to 67%.

-

Exinity clients can speculate on shares from US and Hong Kong companies. Traders can choose between trading stock CFDs or directly buying stocks in large firms commission-free. On the negative side, there are no equities from European and UK markets.

-

xChief offers 100 US company stock CFDs for MT4 DirectFX and Classic+ account holders. Alongside popular multinationals like Apple and Coca-Cola, you can also speculate on several major stock indices with spreads from 2.

-

PU Prime traders can access CFDs on hundreds of shares from international exchanges, including some of the world’s top companies like Amazon, VISA, Tesla, and IBM. Stock trading takes place on the MT5 platform and features floating spreads starting near 0 but varying by account type and equity. Stocks are traded via CFD derivatives and are not directly owned. UK and US stocks all have 0 commissions.

-

SuperForex offers CFDs on a range of international stocks, with big names including Google, Disney and Apple as well as regional powerhouses such as Petrobras. This is not the widest range of stocks, but there is a diverse enough list to keep traders interested, especially beginners.

-

AdroFx offers 40+ stock CFDs on major US companies, including Tesla and Microsoft. These can be traded with leverage, but as they are CFDs you will not directly own a share in the companies. Also, the number of shares is woeful compared to alternatives like CMC Markets which offers over 10,000 stocks spanning different regions and sectors.

-

Invest in thousands of stocks and ETFs with no commissions or overnight fees. You can also make use of the broker's blog which publishes frequent stock market updates and investment ideas.

-

Speculate on price movements of 37 US and European blue chip stock CFDs, including Adidas, Intel and Volkswagen. On the negative side, the selection of stocks is limited vs alternatives and direct share dealing isn't provided.

-

You can trade a modest range of 140+ US and EU shares, including Amazon and Pfizer. There are also 13 major indices, providing exposure to other global economies. Average spreads are competitive, coming in at 0.12 pips for the Apple stock and 1.9 pips for NASDAQ.

-

Trade 20,000+ global equities with margins as low as 5% and powerful trading platforms. The selection of shares outstrips nearly all competitors and includes access to blue chip stocks.

-

Trade 6000+ US and UK stocks and hundreds of ETFs and funds with zero commissions and low fees via an easy-to-use proprietary trading app. More than a million users trust Freetrade for stock investing.

-

I was also pleased to find over 5000 stocks and options available to trade on several platforms, as well as 9 stock indices. Active traders can also enjoy flexible commission plans, superior low-latency DMA and a dedicated customer support line.

-

Global Prime traders cannot speculate on individual stock prices, but they can trade 12 global stock index CFDs with tight spreads, including the Dow Jones, UK 100, NASDAQ and S&P 500.

-

Access UK, European and Asian shares with a good selection of flexible deposit methods. The broker's useful educational insights can also help you develop robust strategies and stock analysis techniques.

-

Trade US, European and Asian markets with thousands of equities and competitive spreads. You can also take advantage of DMA pricing on the broker's MT5 platform, as well as IPOs.

-

As well as Just2Trade's 50+ stock CFDs, traders can access a huge variety of thousands of stocks traded on US and international exchanges. The chance to build an investment portfolio and benefit from dividends sets Just2Trade apart from most CFD brokers.

-

Direct stock trading isn't available, but traders can access 11 index CFDs, including the top US, British, European, Australian, and Japanese indices, with leverage up to 1:200.

-

Trade over 1000 stocks from US, UK and European markets with no commissions. Equities can be traded on the intuitive ActivTrader platform or third-party solutions, while the economic calendar can be used to plan potential trades. Fractional shares are also available, making high-value stocks accessible to newer traders.

-

BlackBull Markets offers CFD trading on an 2000+ global company shares with fast execution via MT4 or MT5. Spreads are variable and competitive, with a typical spread for Apple coming in at 0.04. All shares trading is done through derivatives meaning the company stocks are not bought or sold.

-

Swissquote offers access to leading stock exchanges from Switzerland, US, UK, Germany, France and Japan. Stocks are available with a 0.15% commission on the Premium account. Traders also get a choice of leading platforms, including MT4, MT5 and Advanced Trader.

-

SimpleFX offers a beginner-friendly platform to trade some of the most popular global stock CFDs commission-free, from Pfizer to Walt Disney, equipped with advanced integrated indicators. SimpleFX provides access to stock exchanges in key countries such as the US, UK, Germany, and Japan, though it doesn't offer fractional shares.

-

You can trade 70+ of the most popular global stocks including Amazon and Tesla, as well as 10+ major indices. This isn’t particularly competitive compared to the hundreds offered by most alternatives, and the lack of additional analysis tools will disappoint seasoned stock traders.

-

You can trade a small range of around 20 major NYSE and NASDAQ-listed stocks, including Apple, Google and Amazon. Commissions are also uncompetitive at $16 per round turn - over double the rate at most other brokers.

-

Traders can speculate on stock market movements through CFDs on dozens of individual equities. This is less than many rival brokers, but traders can also place bets on broad market movements through 15 indices covering diverse global markets including the US, China, UK, Spain and Germany.

-

FXTrading offers clients CFDs on 10,000+ global company shares from a list that includes all major and emerging stock exchanges on an institutional trading platform. Prices are competitive with a floating spread and leverage of 1:10 is available.

-

Trade hundreds of stocks from leading countries and economics, including Apple and Amazon in the US. 24/5 support is also available to help new stock traders get started with the broker.

-

Trade CFDs on some of the largest stocks in the US and EU including big brands like Microsoft and Google. In total, 70+ global stock CFDs are available with leverage up to 1:5.

-

Fortrade offers leveraged CFDs on a wide range of stocks from the UK, US, Hong Kong, Australia and a range of European companies with variable spreads and no commissions. CFDs are derivative contracts that do not entail ownership of the underlying stock. Professional traders can also access a decent list of Direct Market Access stocks.

-

FP Markets offers CFDs on over 10,000 international stocks across a wide range of global markets, including exchanges in London, Hong Kong, Paris, Frankfurt, Madrid, Amsterdam, and New York. Yet while the broker offers extensive coverage in CFD trading, it does not support real stock trading or long-term investing.

-

IronFX traders can speculate on price movements of 150 US, UK and European shares via CFDs. Fractional shares are also available, which will appeal to beginners looking to trade in smaller volumes. There’s also a decent range of 15+ indices via spot and futures contracts.

-

Trade CFDs on an impressive range of 3400+ stocks from 17 different global exchanges with low commissions. Traders can also buy and own company shares directly with low commissions and fee-free trades available daily from some exchanges, and fractional share trading allowing micro-investments in international giants.

-

You can trade 68 stocks and shares with leverage of 1:5, as well as 4 indices: Dow Jones, Nasdaq, S&P 500 and DAX 30. This is a poor selection compared to most alternatives (who typically offer hundreds) and only covers US and German markets.

-

HYCM offers 11 individual company shares to trade via the MT4 platform. There are also 20 ETFs to give a broader view of market movements. All trading is done through CFDs, meaning traders will not own the underlying equities.

-

FXOpen users can trade CFDs on 10 US shares including Boeing and Tesla with leverage up to 1:5. Nine stock indices are also available to trade with leverage up to 1:20. While a modest selection of equities, trading conditions are competitive and leading platforms are available.

-

Trade 750 stock CFDs sourced from eight exchanges from the US, EU and UK. Leverage up to 1:10 is available, commissions start from $6 and overnight fees are the LIBOR rate +/-3.5%. This represents a very competitive suite of stocks from a range of international markets covered by few competitors.

-

Hantec Markets offers more than 1,800 stock CFDs from exchanges in Europe, the UK, and the US. Additionally, the broker offers access to major indices including the S&P 500 and FTSE 100, allowing traders to gain a comprehensive perspective on global financial markets. On the downside, there is no option to invest in real stocks or factional shares, available at XTB.

-

Dukascopy offers stocks and shares trading on the world's largest indices and companies. Users have access to North America, Europe and the Pacific region with competitive pricing. The broker's market research, including its technical and fundamental analysis, trading ideas and TV channel, are standout features for us.

-

Stocks can be traded by connecting the NinjaTrader platform to supporting brokers. The firm also provides access to a range of index futures via standard and micro contracts, including the E-Mini S&P 500 Index Futures and E-Mini Russell 2000 Index Futures.

-

GO Markets offers CFDs on stocks from US, UK, Hong Kong, Australian and German exchanges with 1:5 leverage, commissions from 0.08%, tight variable spreads, and access to powerful analysis tools on MetaTrader 5. Derivatives trading means traders will not own the underlying asset.

-

Access 23,500+ stocks from global markets with a $1 minimum commission on US shares and comprehensive market insights.

-

Trade thousands of global equities through spread betting and CFDs. Spreadex is one of the few online brokers to provide trading opportunities on a selection of lower market cap equities traded on exchanges such as the AIM sub-market of the London Stock Exchange.

-

Although the broker doesn’t offer real stocks, clients can trade CFDs on an impressive list of 3000+ shares with low commissions from $3.50 per side and no hidden fees. Spreads are also competitive, coming in at 0.08 pips for the Apple stock.

-

Traders can speculate on leading companies in the US, EU, UK and Australia including brands like Tesla and Apple. Short, medium and long-term trading strategies are catered for, as well as algo traders through Expert Advisors (EAs). There is also an excellent range of indices and ETFs for those who want to diversify portfolios.

-

Traders can take positions on thousands of stock CFDs sourced from various global markets, including the US, UK, EU, China, and Japan. For longer-term investors, Trading 212 facilitates direct share dealing on more than 8,500 global stocks within investment accounts and tax-efficient ISAs for UK customers. The key selling point is the zero commissions on equities.

-

Pepperstone presents a huge suite of share CFDs spanning the US, UK, Australian, and European stock markets. Whether you’re interested in iconic names like Tesla, Apple, or Netflix, Pepperstone provides the flexibility to take long or short positions, backed by deep liquidity and competitive commissions. The platform has also introduced 24-hour trading on 37 US stock CFDs, providing opportunities to trade following earnings reports and unexpected news.

-

FXTM offers a modest selection of several hundred US and European stock CFDs, with Advantage account spreads starting from just 0.1. You can also trade over 500 real shares from US exchanges. What’s great is the wealth of expertly curated market analysis to informed decision-making.

-

Trade dozens of shares in major US, European, and Asian companies.

-

You can trade major indices including the NASDAQ, S&P 500 and Nikkei. There’s a powerful platform for technical and fundamental analysis of the market, although it’s a shame that shares are not offered.

-

easyMarkets only offers 45+ global equities from US, European, Chinese and Japanese firms, which is much less than most competitors. With that said, there is also a decent range of 13 global stock indices including the S&P 500 and UK 100, with high leverage up to 1:400.

-

FXCM offers a strong suite of shares from the US, UK, Hong Kong, Australia and Europe. Extended hours trading is available on US shares, aligning the broker with top brands like IG. Additionally, fractional shares are available for those who want more control over their position sizes.

-

100+ stock CFDs are available spanning some of the biggest US companies with zero commissions. The economic calendar is great for tracking major events which could impact stock prices. However, Fusion only offers US shares whereas competitors like IC Markets provide 2000+ shares including Australian stocks.

-

XTB offers over 3,000 stocks (CFD and real), encompassing prominent companies such as Amazon, Barclays, and BMW, with zero commissions. The xStation platform also shines for its analysis features that elevate the stock trading experience, from stock scanners and heatmaps to diverse fundamental data, including market cap and P/E ratios.

-

Trader can access global stock markets through binary options on blue chip company shares and a range of indices. Clients can trade high/low binaries on a user-friendly web platform.

-

AZAForex offers trading on a modest range of US stocks including Google, Apple and Amazon. You can also speculate on leading indices such as the FTSE.

-

Go long or short on over 50 major global shares and map out your strategies using the intuitive charting tools. Those with $1,000+ starting capital can also enjoy their first 3 trades risk-free.

-

Capital.com offer 5,600+ stocks from around the globe. They also offer tight spreads, ideal for active traders

Cyclical Stock Sectors

When identifying cyclical stocks and sectors, it is perhaps easiest to think about the types of goods and services that we will be more likely to use when we have excess cash in our pockets. Our spending habits change, and we begin to buy the items that we would like to own rather than (or as well as) the items we need.

When times are a little harder, our spending is dictated at least as much by affordability as by desire. When work is plentiful, wages rising, job offers ten-a-penny, we are more likely to visit a car showroom and buy the cabriolet we always wanted, but when we are living in fear of losing our jobs, then perhaps taking our current model to the service station is more appropriate. Car manufacturers and dealers are most definitely on the list of cyclical stocks.

We all need to eat, of course, but when we have cash in our pocket we are more likely to take the family to a restaurant, maybe even high end, rather than face the drudgery of the washing up after a meal. Restaurant chains are also on the list of cyclical stocks.

Other sectors that prosper most through the good times include house builders, hotels, airlines, and travel companies. Any company that manufactures or sells luxury goods and services also belong on the list of cyclical stocks.

Defensive Stock Sectors

On the other hand, when times are tough, and we are living in fear of losing our jobs, then our spending contracts. We tend to see the future with pessimism and spend accordingly.

That car that would be bought in the good times can wait a year or two. But there are essentials that we all require to live, and live in comfort.

For example, we all need to eat. But it’s cheaper to eat at home rather than eat out. As a treat we might take the children to MacDonald’s, or visit a ‘proper’ restaurant once a fortnight. Other than this, we’ll buy more at the supermarket and eat in. Food retailers, particularly no frills chains, and fast food restaurants are defensive stocks.

We need heat and lighting, too. And water, to drink, cook with, and bath in. Utility companies are top of the list of defensive stocks, and often have a captive audience as their customer base.

The same with healthcare companies: health is important to most people, and governments tend to spend more on healthcare when times are tough. Pharmaceutical companies, drugs manufacturers, and medical insurance companies weather an economic downturn well.

Companies that produce non-durable goods, such as household supplies, soaps, detergents, and toothpastes hold sales steady throughout an economic cycle.

Price performance of cyclical and defensive stocks

When the economy is roaring, and we are doing well and spending more, companies that produce goods or services that pander to our desires rather than our needs sell more. Revenues increase, companies can raise prices more easily and margins grow. When the economy falters, so too does our spending. Cyclical companies have to respond to falling demand by cutting prices, and margins retreat. Cyclical stocks tend to rise and fall with the economic cycle.

Dividends, too, paid by cyclical companies will be better when the economy is expanding, and worsen when the economy comes back.

Defensive stocks tend to see sales remain relatively stable throughout a cycle (though some discount manufacturers benefit more due to pricing policy). Revenues, earnings and dividends tend to stay ion an even keel, as do dividends.

Theoretically at least, an investor should buy a cyclical stock as the economy is recovering and prepare for the share price rises to come. As the economy hits its peak, and GDP growth starts to ease back and turn neutral or negative, then defensive stocks will outperform cyclical stocks.

In conclusion

Understanding how cyclical and defensive stocks behave through an economic cycle will help you to make better investment decisions and time fund switches with better accuracy for long term portfolio health. Of course, defensive stock prices may also fall during a large scale recession, but they are likely to hold better than cyclical stocks, and also more likely to continue to pay dividends.